Question: Your company makes expensive time pieces which require the use of the precious metal, palladium. Any increase in the price of palladium is not passed

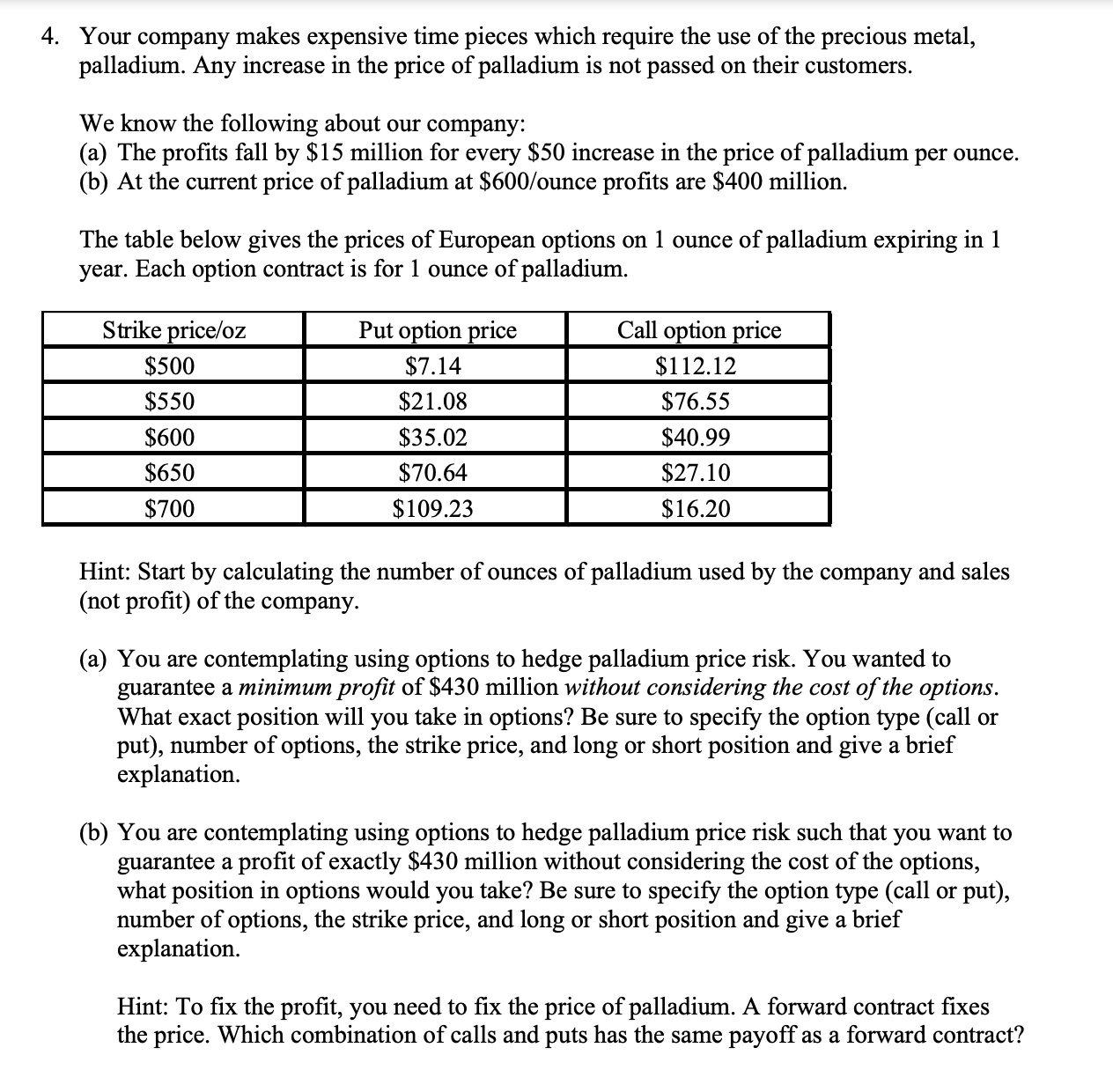

Your company makes expensive time pieces which require the use of the precious metal, palladium. Any increase in the price of palladium is not passed on their customers. We know the following about our company: (a) The profits fall by $15 million for every $50 increase in the price of palladium per ounce. (b) At the current price of palladium at $600 /ounce profits are $400 million. The table below gives the prices of European options on 1 ounce of palladium expiring in 1 year. Each option contract is for 1 ounce of palladium. Hint: Start by calculating the number of ounces of palladium used by the company and sales (not profit) of the company. (a) You are contemplating using options to hedge palladium price risk. You wanted to guarantee a minimum profit of $430 million without considering the cost of the options. What exact position will you take in options? Be sure to specify the option type (call or put), number of options, the strike price, and long or short position and give a brief explanation. (b) You are contemplating using options to hedge palladium price risk such that you want to guarantee a profit of exactly $430 million without considering the cost of the options, what position in options would you take? Be sure to specify the option type (call or put), number of options, the strike price, and long or short position and give a brief explanation. Hint: To fix the profit, you need to fix the price of palladium. A forward contract fixes the price. Which combination of calls and puts has the same payoff as a forward contract? Your company makes expensive time pieces which require the use of the precious metal, palladium. Any increase in the price of palladium is not passed on their customers. We know the following about our company: (a) The profits fall by $15 million for every $50 increase in the price of palladium per ounce. (b) At the current price of palladium at $600 /ounce profits are $400 million. The table below gives the prices of European options on 1 ounce of palladium expiring in 1 year. Each option contract is for 1 ounce of palladium. Hint: Start by calculating the number of ounces of palladium used by the company and sales (not profit) of the company. (a) You are contemplating using options to hedge palladium price risk. You wanted to guarantee a minimum profit of $430 million without considering the cost of the options. What exact position will you take in options? Be sure to specify the option type (call or put), number of options, the strike price, and long or short position and give a brief explanation. (b) You are contemplating using options to hedge palladium price risk such that you want to guarantee a profit of exactly $430 million without considering the cost of the options, what position in options would you take? Be sure to specify the option type (call or put), number of options, the strike price, and long or short position and give a brief explanation. Hint: To fix the profit, you need to fix the price of palladium. A forward contract fixes the price. Which combination of calls and puts has the same payoff as a forward contract

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts