Question: Your company uses the DDB method. Assets purchased between the 1st and 15th are depreciated for the entire month; assets purchased after the 15th as

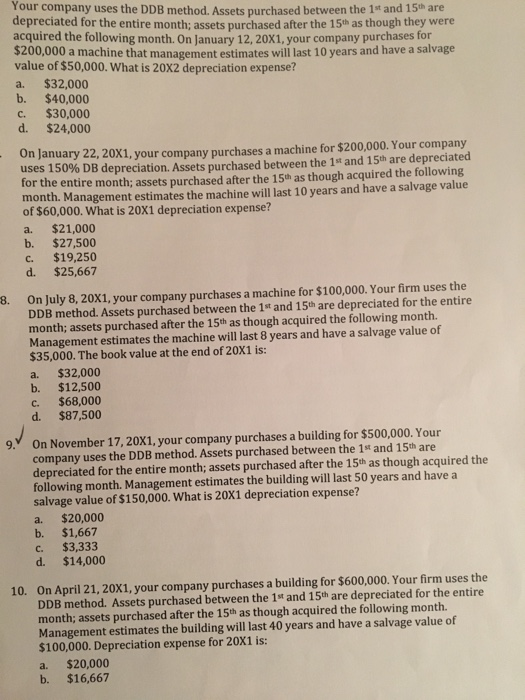

Your company uses the DDB method. Assets purchased between the 1st and 15th are depreciated for the entire month; assets purchased after the 15th as though they were acquired the following month. On January 12, 20X1, your company purchases for $200,000 a machine that management estimates will last 10 years and have a salvage value of $50,000. What is 20X2 depreciation expense? a. $32,000 b. $40,000 c. $30,000 d. $24,000 On January 22, 20X1, your company purchases a machine for $200,000. Your company uses 150% DB depreciation. Assets purchased between the 1st and 150 are depreciated for the entire month; assets purchased after the 15h as though acquired the following month. Management estimates the machine will last 10 years and have a salvage value of $60,000. What is 20X1 depreciation expense? a. $21,000 b. $27,500 c. $19,250 d. $25,667 On July 8,20X1, your company purchases a machine for $100,000. Your firm uses the DDB method. Assets purchased between the 1st and 15th are depreciated for the entire month; assets purchased after the 15th as though acquired the following month Management estimates the machine will last 8 years and have a salvage value of $35,000. The book value at the end of 20X1 is: a. $32,000 b. $12,500 c. $68,000 d. $87,500 8. 9.On November 17, 20X1, your company purchases a building for $500,000. Your company uses the DDB method. Assets purchased between the 1st and 15th are depreciated for the entire month; assets purchased after the 15th as though acquired the following month. Management estimates the building will last 50 years and have a salvage value of $150,000. What is 20X1 depreciation expense? a. $20,000 b. $1,667 c. $3,333 d. $14,000 On April 21, 20X1, your company purchases a building for $600,000. Your firm uses the DDB method. Assets purchased between the 1st and 15th are depreciated for the entire month; assets purchased after the 15th as though acquired the following month. Management estimates the building will last 40 years and have a salvage value of $100,000. Depreciation expense for 20X1 is: a. $20,000 b. $16,667 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts