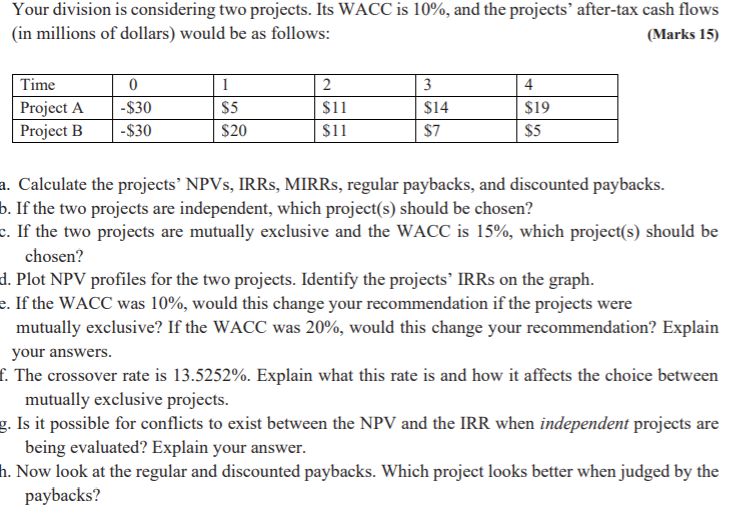

Question: Your division is considering two projects. Its WACC is 10%, and the projects' after-tax cash flows (in millions of dollars) would be as follows: (Marks

Your division is considering two projects. Its WACC is 10%, and the projects' after-tax cash flows (in millions of dollars) would be as follows: (Marks 15) Time Project A Project B 0 -$30 -$30 1 $5 $20 2 $11 $11 3 $14 $7 4 $19 $5 a. Calculate the projects' NPVS, IRRS, MIRRs, regular paybacks, and discounted paybacks. b. If the two projects are independent, which project(s) should be chosen? c. If the two projects are mutually exclusive and the WACC is 15%, which project(s) should be chosen? d. Plot NPV profiles for the two projects. Identify the projects' IRRs on the graph. e. If the WACC was 10%, would this change your recommendation if the projects were mutually exclusive? If the WACC was 20%, would this change your recommendation? Explain your answers. f. The crossover rate is 13.5252%. Explain what this rate is and how it affects the choice between mutually exclusive projects. g. Is it possible for conflicts to exist between the NPV and the IRR when independent projects are being evaluated? Explain your answer. h. Now look at the regular and discounted paybacks. Which project looks better when judged by the paybacks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts