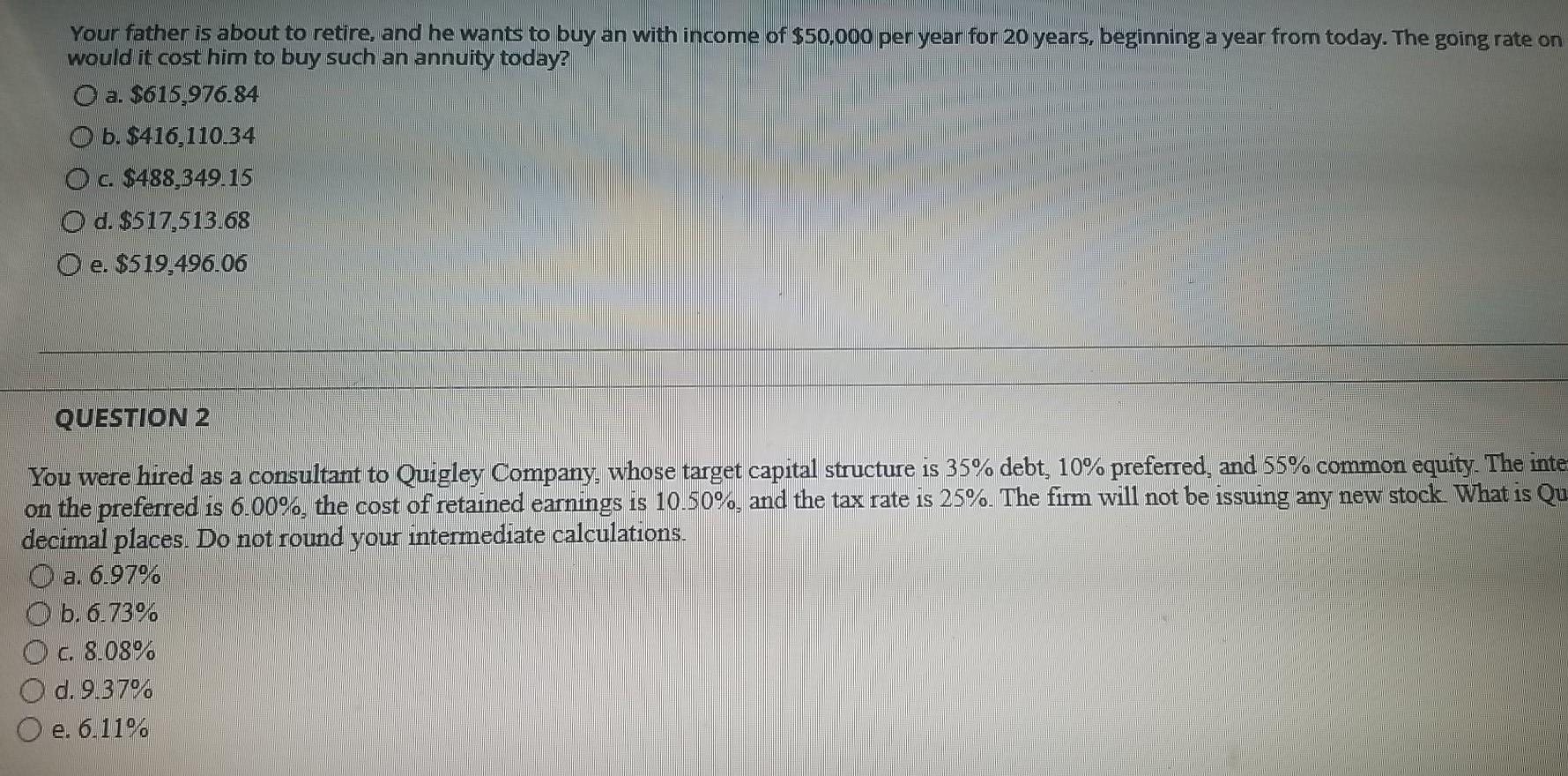

Question: Your father is about to retire, and he wants to buy an with income of $50,000 per year for 20 years, beginning a year from

Your father is about to retire, and he wants to buy an with income of $50,000 per year for 20 years, beginning a year from today. The going rate on would it cost him to buy such an annuity today? O a. $615,976.84 O b. $416, 110.34 O c. $488,349.15 O d. $517,513.68 O e. $519,496.06 QUESTION 2 You were hired as a consultant to Quigley Company, whose target capital structure is 35% debt, 10% preferred, and 55% common equity. The inte on the preferred is 6.00%, the cost of retained earnings is 10.50%, and the tax rate is 25%. The firm will not be issuing any new stock. What is Qu decimal places. Do not round your intermediate calculations. O a. 6.97% O b.6.73% O c. 8.08% d. 9.37% O e. 6.11% Your father is about to retire, and he wants to buy an with income of $50,000 per year for 20 years, beginning a year from today. The going rate on would it cost him to buy such an annuity today? O a. $615,976.84 O b. $416, 110.34 O c. $488,349.15 O d. $517,513.68 O e. $519,496.06 QUESTION 2 You were hired as a consultant to Quigley Company, whose target capital structure is 35% debt, 10% preferred, and 55% common equity. The inte on the preferred is 6.00%, the cost of retained earnings is 10.50%, and the tax rate is 25%. The firm will not be issuing any new stock. What is Qu decimal places. Do not round your intermediate calculations. O a. 6.97% O b.6.73% O c. 8.08% d. 9.37% O e. 6.11%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts