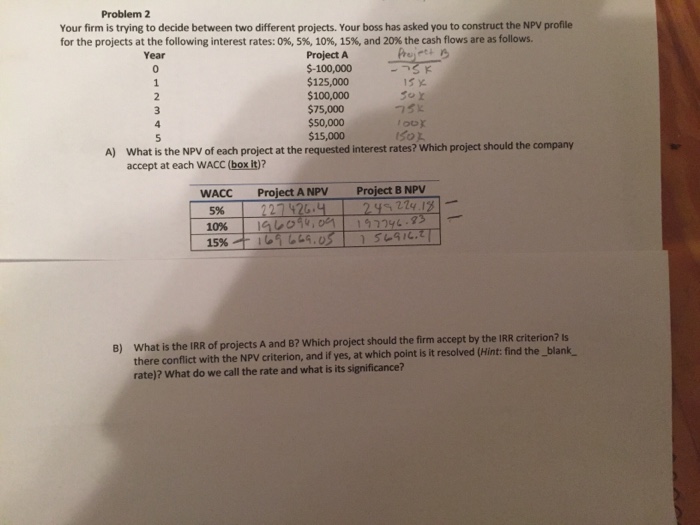

Question: Your firm is trying to decide between two different projects. Your boss has asked you to construct the NPv profile for the projects at the

Your firm is trying to decide between two different projects. Your boss has asked you to construct the NPv profile for the projects at the following interest rates: 0%, 5%, 10%, 15%, and 20% the cash flows are as follows. What is the NPV of each project at the requested interest rates? Which project should the company accept at each WACC (box it)? What is the IRR of projects A and B? Which project should the firm accept by the IRR criterion? Is there conflict with the NPV criterion, and if yes, at which point is it resolved What do we call the rate and what is its significance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts