Question: Your firm needs a computerized machine tool lathe which costs $47,000 and requires $11,700 in maintenance for each year of its 3-year life. After three

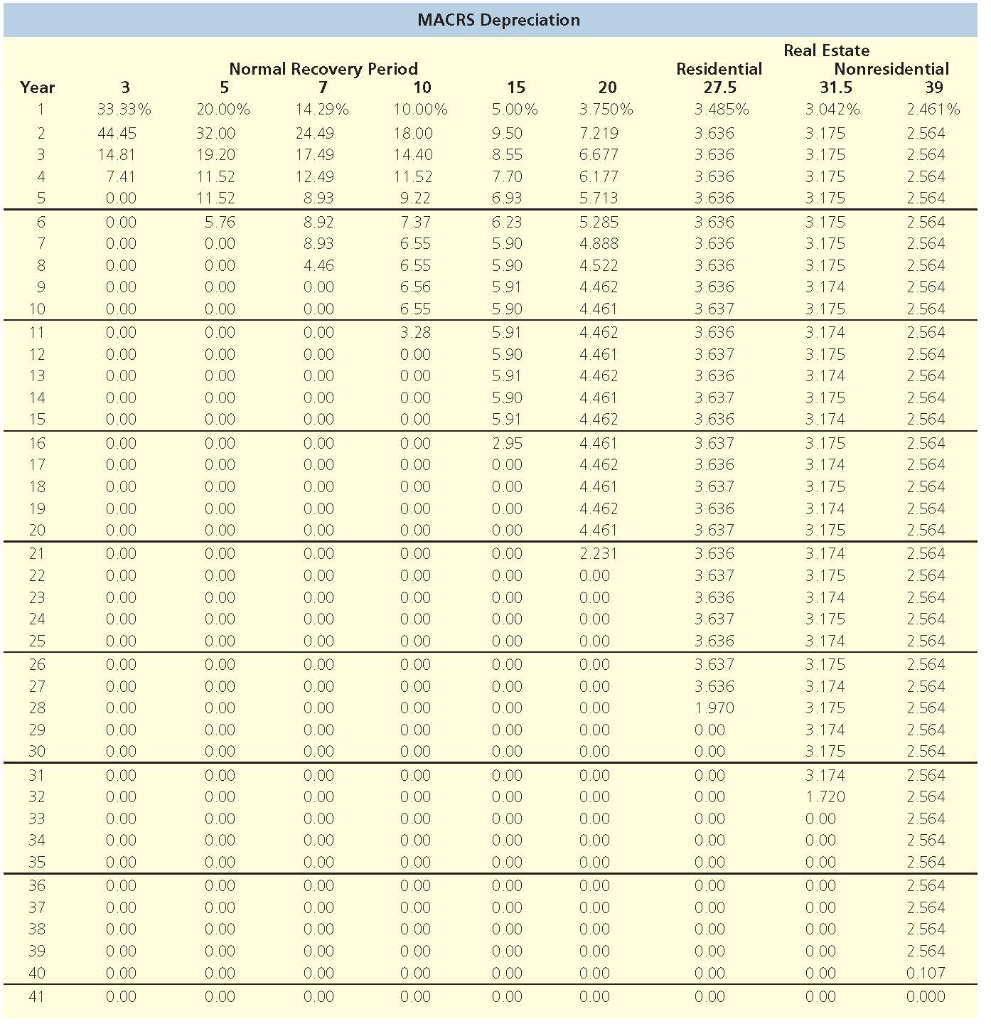

Your firm needs a computerized machine tool lathe which costs $47,000 and requires $11,700 in maintenance for each year of its 3-year life. After three years, this machine will be replaced. The machine falls into the MACRS 3-year class life category. Assume a tax rate of 34 percent and a discount rate of 11 percent. Calculate the depreciation tax shield for this project in year 3. (Round your answer to 2 decimal places.)

MACRS Depreciation Year 15 5.00% 9.50 8.55 7.70 6.93 6.23 5.90 0.00 4.46 0.00 5.90 5.91 5.90 5.91 5.90 0.00 5.91 5.90 20 3.750% 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2.231 0.00 0.00 0.00 0.00 0.00 0.00 0.00 3 33.33% 44.45 14.81 7.41 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Normal Recovery Period 5 7 10 20.00% 14.29% 10.00% 32.00 24.49 18.00 19.20 17.49 14.40 11.52 12.49 11.52 11.52 8.93 9.22 5.76 8.92 737 0.00 8.93 6.55 6.55 0.00 6.56 0.00 0.00 655 0.00 0.00 3.28 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0 00 0.00 0.00 000 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 000 0.00 0.00 000 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 000 0.00 0.00 000 0.00 0.00 0.00 0.00 0.00 0.00 0.00 000 0.00 0.00 000 0.00 0.00 000 0.00 0.00 0.00 5.91 2.95 0.00 0.00 0.00 0.00 Residential 27.5 3.485% 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 1.970 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Real Estate Nonresidential 31.5 39 3.042% 2.461% 3.175 2.564 3.175 2.564 3.175 2.564 3.175 2.564 3.175 2.564 3.175 2.564 3.175 2.564 3.174 2.564 3.175 2.564 3.174 2.564 3.175 2.564 3.174 2.564 3.175 2.564 3.174 2.564 3.175 2.564 3.174 2.564 3.175 2.564 3.174 2.564 3.175 2.564 3.174 2.564 3.175 2.564 3.174 2.564 3.175 2.564 3.174 2.564 3.175 2.564 3.174 2.564 3.175 2.564 3.174 2.564 3.175 2.564 3.174 2.564 1.720 2.564 0.00 2.564 0.00 2.564 0.00 2.564 0.00 2.564 0.00 2.564 0.00 2.564 2.564 0.00 0.107 0.00 0.000 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 000 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts