Question: Your firm needs a computerized machine tool lathe which costs $52,000 and requires $12,200 in maintenance for each year of its 3 year life. After

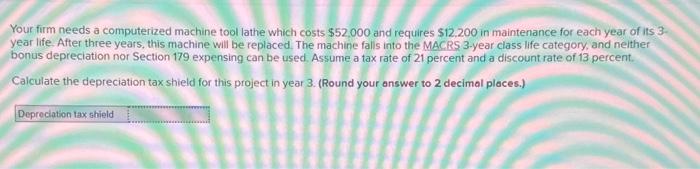

Your firm needs a computerized machine tool lathe which costs $52,000 and requires $12,200 in maintenance for each year of its 3 year life. After three years, this machine will be replaced. The machine falis into the MACRS 3-year class life category, and neither bonus depreciation nor Section 179 expensing can be used. Assume a tax rate of 21 percent and a discount rate of 13 percent. Caiculate the depreciation tax shield for this project in year 3 . (Round your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts