Question: Your firm needs a rapid prototyping machine and will either lease the machine for an end-of-year cost of $ 5000 for a 6 year period,

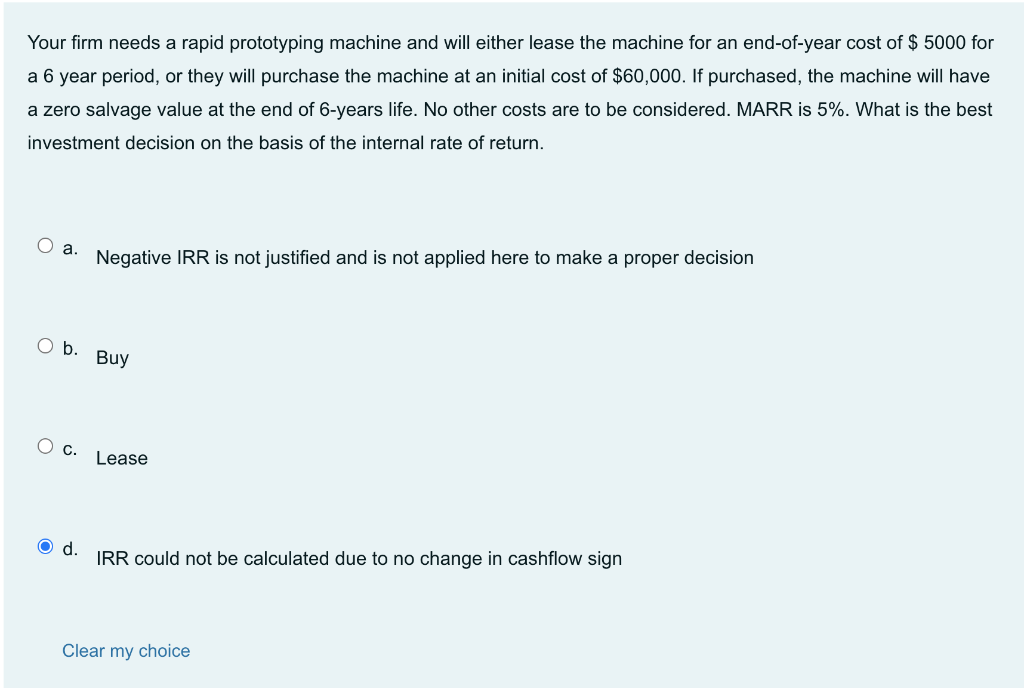

Your firm needs a rapid prototyping machine and will either lease the machine for an end-of-year cost of $ 5000 for a 6 year period, or they will purchase the machine at an initial cost of $60,000. If purchased, the machine will have a zero salvage value at the end of 6-years life. No other costs are to be considered. MARR is 5%. What is the best investment decision on the basis of the internal rate of return. . Negative IRR is not justified and is not applied here to make a proper decision Ob. Buy O c. Lease O d. IRR could not be calculated due to no change in cashflow sign Clear my choice

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts