Question: Your firm recently divested some non-core assets and now has a significant amount of excess cash. Branda Sim, the CEO, is considering investing in either

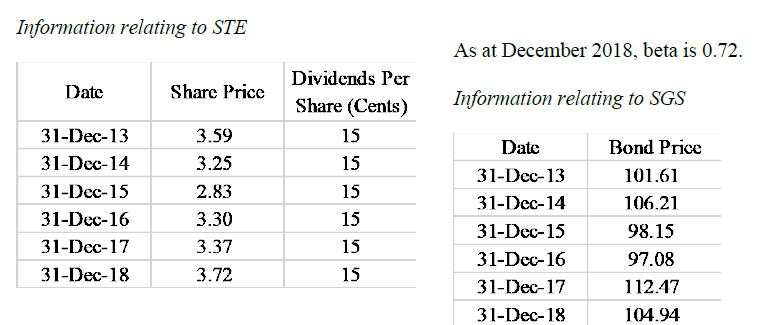

Your firm recently divested some non-core assets and now has a significant amount of excess cash. Branda Sim, the CEO, is considering investing in either Singapore Technologies Engineering Limited (STE) shares or 10-year Singapore Government Securities (SGS) or a combination of both. She knows that you are studying a Finance course, and she is seeking your advice. Based on your research, the following market data was obtained:

Question:

Discuss the differences between systematic risk and total risk, and ascertain which measure of is more appropriate for the firm to use.

Information relating to STE As at December 2018, beta is 0.72. Date Share Price Dividends Per Share (Cents) Information relating to SGS 31-Dec-13 31-Dec-14 31-Dec-15 31-Dec-16 31-Dec-17 31-Dec-18 3.59 3.25 2.83 3.30 3.37 3.72 Date 31-Dec-13 31-Dec-14 31-Dec-15 31-Dec-16 31-Dec-17 31-Dec-18 Bond Price 101.61 106.21 98.15 97.08 112.47 104.94

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts