Question: Your industry typically values a business using a 20 percent discount rate. Youve forecasted that your company, Hi-Fidelity Innovations, LLC, will enjoy expected cash flows

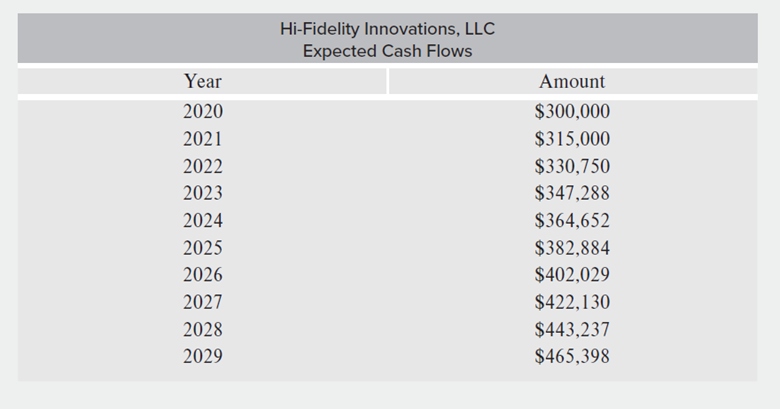

Your industry typically values a business using a 20 percent discount rate. Youve forecasted that your company, Hi-Fidelity Innovations, LLC, will enjoy expected cash flows for the next 10 years as shown below (see table):

Calculate the equity value of your business using the discounted cash flow method, using a 20 percent discount rate, and assuming that the expected cash flow of the last forecasted year will stabilize and continue to grow in perpetuity by 2.5 percent per year. By how much would the results differ if we used a 12 percent discount rate instead of 20 percent? Show your calculations.

Hi-Fidelity Innovations, LLC Expected Cash Flows \begin{tabular}{c|c} Year & Amount \\ 2020 & $300,000 \\ 2021 & $315,000 \\ 2022 & $330,750 \\ 2023 & $347,288 \\ 2024 & $364,652 \\ 2025 & $382,884 \\ 2026 & $402,029 \\ 2027 & $422,130 \\ 2028 & $443,237 \\ 2029 & $465,398 \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts