Question: Your industry typically values a business using a 25 percent discount rate. Youve forecasted that your company, Benson Manufacturing, Inc., will enjoy expected cash flows

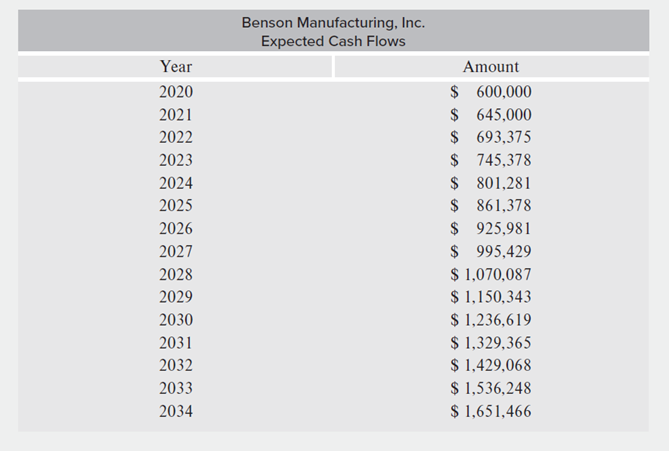

Your industry typically values a business using a 25 percent discount rate. Youve forecasted that your company, Benson Manufacturing, Inc., will enjoy expected cash flows for the next 15 years as indicated below: Note the following present value factors for a 25 percent discount rate: 0.8000 (n = 1), 0.6400 (n = 2), 0.5120 (n = 3), 0.4096 (n = 4), 0.3277 (n = 5), 0.2621 (n = 6), 0.2097 (n = 2), 0.1678 (n = 8), 0.1342 (n = 9), 0.1074 (n = 10), 0.0859 (n = 11), 0.0687 (n = 12), 0.0550 (n = 13), 0.0440 (n = 14), 0.0352 (n = 15). Calculate the equity value of your business using the discounted cash flow method, using a 25 percent discount rate, and assuming that the expected cash flow of the last forecasted year will stabilize and continue to grow in perpetuity by 2 percent per year. Next, answer the following questions: Assuming Benson Manufacturing, Inc. has 100,000 shares of common stock outstanding, what is the value of each share of this stock based on the equity value of the business you just calculated? If your company has $175,000 of debt and $35,000 of cash on its balance sheet, what is the enterprise value of this business?

Benson Manufacturing, Inc. Expected Cash Flows Year202020212022202320242025202620272028202920302031203220332034Amount$600,000$645,000$693,375$745,378$801,281$861,378$925,981$995,429$1,070,087$1,150,343$1,236,619$1,329,365$1,429,068$1,536,248$1,651,466

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts