Question

Your plantation company has produced 10,000 tonnes of palm oil. Today is early May 2006 and you managed to sell only 3,000 tonnes in

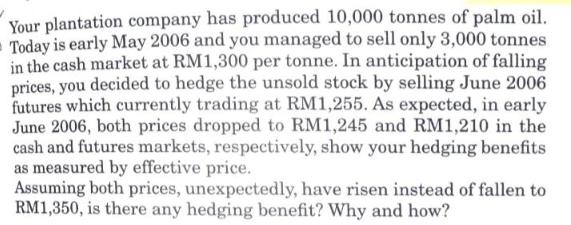

Your plantation company has produced 10,000 tonnes of palm oil. Today is early May 2006 and you managed to sell only 3,000 tonnes in the cash market at RM1,300 per tonne. In anticipation of falling prices, you decided to hedge the unsold stock by selling June 2006 futures which currently trading at RM1,255. As expected, in early June 2006, both prices dropped to RM1,245 and RM1,210 in the cash and futures markets, respectively, show your hedging benefits as measured by effective price. Assuming both prices, unexpectedly, have risen instead of fallen to RM1,350, is there any hedging benefit? Why and how?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To analyze the hedging benefits lets break down the scenario step by step Initial Situation You produced 10000 tonnes of palm oil Sold 3000 tonnes in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management Accounting

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu

6th Canadian edition

013257084X, 1846589207, 978-0132570848

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App