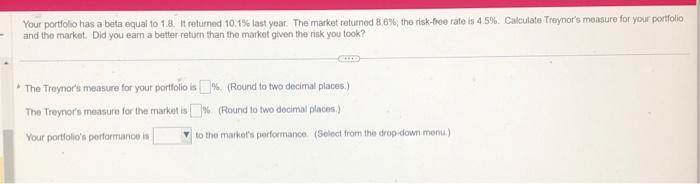

Question: Your portfolio has a beta equal to 1.8 . It returned 10.1% last year. The market returned 8.6%, the risk-free rate is 4.5%. Calculate Treynor's

Your portfolio has a beta equal to 1.8 . It returned 10.1% last year. The market returned 8.6%, the risk-free rate is 4.5%. Calculate Treynor's mensure for your portfolio and the market. Did you earn a better return than the market given the risk you took? - The Troymor's measure for your portiolio is \%o. (Round to two decimal places.) The Treynor's measure for the market is V. (Round to two decimal places.) Your portlolio's pertormance is to the markets performance. (Select from the drop-down menu;)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts