Question: Wilbur Bank and Templeton Bank compete with each other in the market for consumer deposits. They offer interest rates on deposits, and the higher

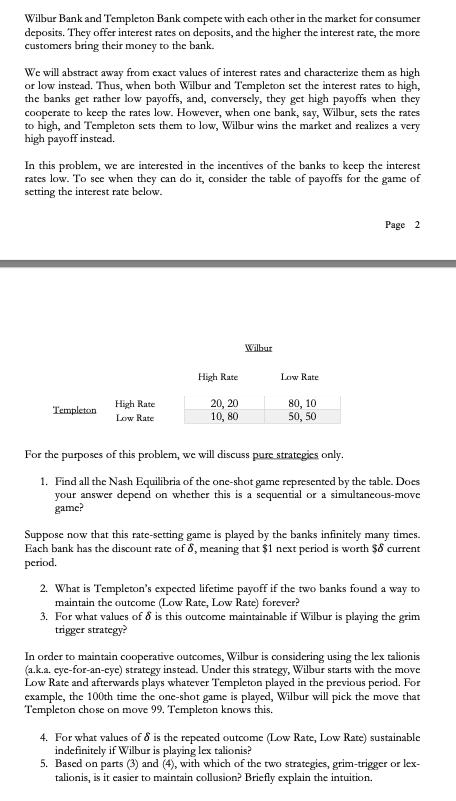

Wilbur Bank and Templeton Bank compete with each other in the market for consumer deposits. They offer interest rates on deposits, and the higher the interest rate, the more customers bring their money to the bank. We will abstract away from exact values of interest rates and characterize them as high or low instead. Thus, when both Wilbur and Templeton set the interest rates to high, the banks get rather low payoffs, and, conversely, they get high payoffs when they cooperate to keep the rates low. However, when one bank, say, Wilbur, sets the rates to high, and Templeton sets them to low, Wilbur wins the market and realizes a very high payoff instead. In this problem, we are interested in the incentives of the banks to keep the interest rates low. To see when they can do it, consider the table of payoffs for the game of setting the interest rate below. Templeton. High Rate Low Rate High Rate 20, 20 10, 80 Wilbur Low Rate 80, 10 50, 50 Page 2 For the purposes of this problem, we will discuss pure strategies only. 1. Find all the Nash Equilibria of the one-shot game represented by the table. Does your answer depend on whether this is a sequential or a simultaneous-move game? Suppose now that this rate-setting game is played by the banks infinitely many times. Each bank has the discount rate of 8, meaning that $1 next period is worth $8 current period. 2. What is Templeton's expected lifetime payoff if the two banks found a way to maintain the outcome (Low Rate, Low Rate) forever? 3. For what values of 8 is this outcome maintainable if Wilbur is playing the grim trigger strategy? In order to maintain cooperative outcomes, Wilbur is considering using the lex talionis (a.k.a. eye-for-an-eye) strategy instead. Under this strategy, Wilbur starts with the move Low Rate and afterwards plays whatever Templeton played in the previous period. For example, the 100th time the one-shot game is played, Wilbur will pick the move that Templeton chose on move 99. Templeton knows this. 4. For what values of 8 is the repeated outcome (Low Rate, Low Rate) sustainable indefinitely if Wilbur is playing lex talionis? 5. Based on parts (3) and (4), with which of the two strategies, grim-trigger or lex- talionis, is it easier to maintain collusion? Briefly explain the intuition.

Step by Step Solution

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Lets find all the Nash Equilibria NE of the oneshot game represented by the table a If both banks set a high rate HH Wilbur gets a payoff of 20 Templeton gets a payoff of 20 This is a NE because no ba... View full answer

Get step-by-step solutions from verified subject matter experts