Question: Your venture has signed a new consulting contract that will require you to invest in new analytical software and a new computer. The contract

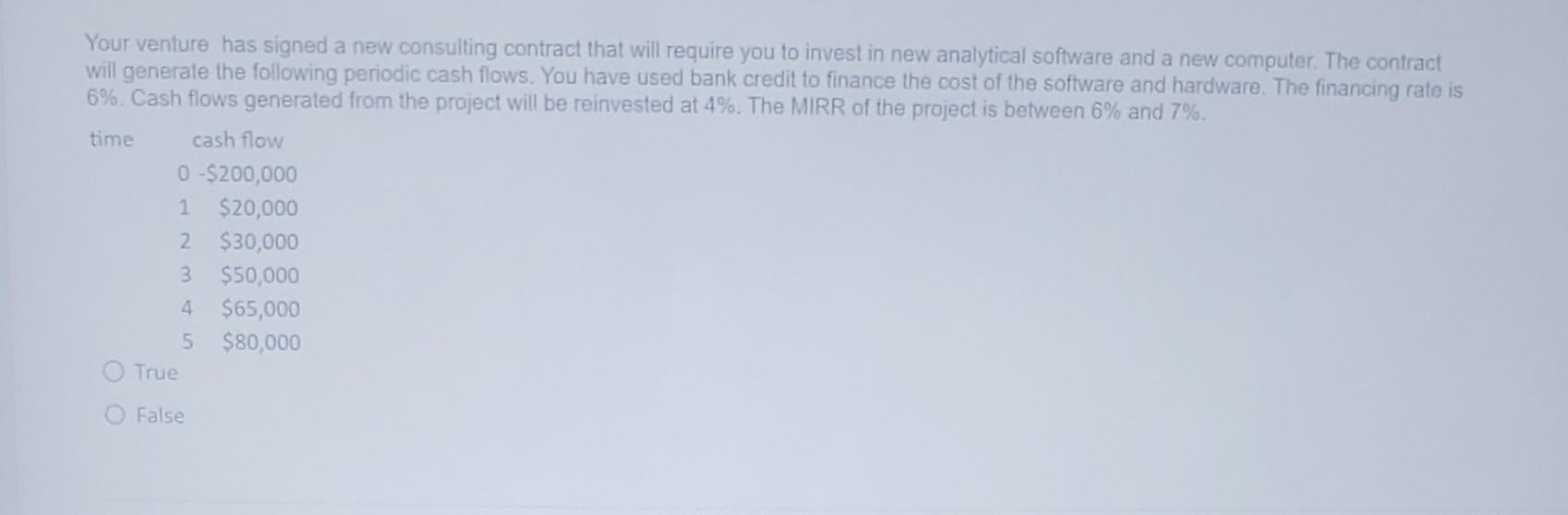

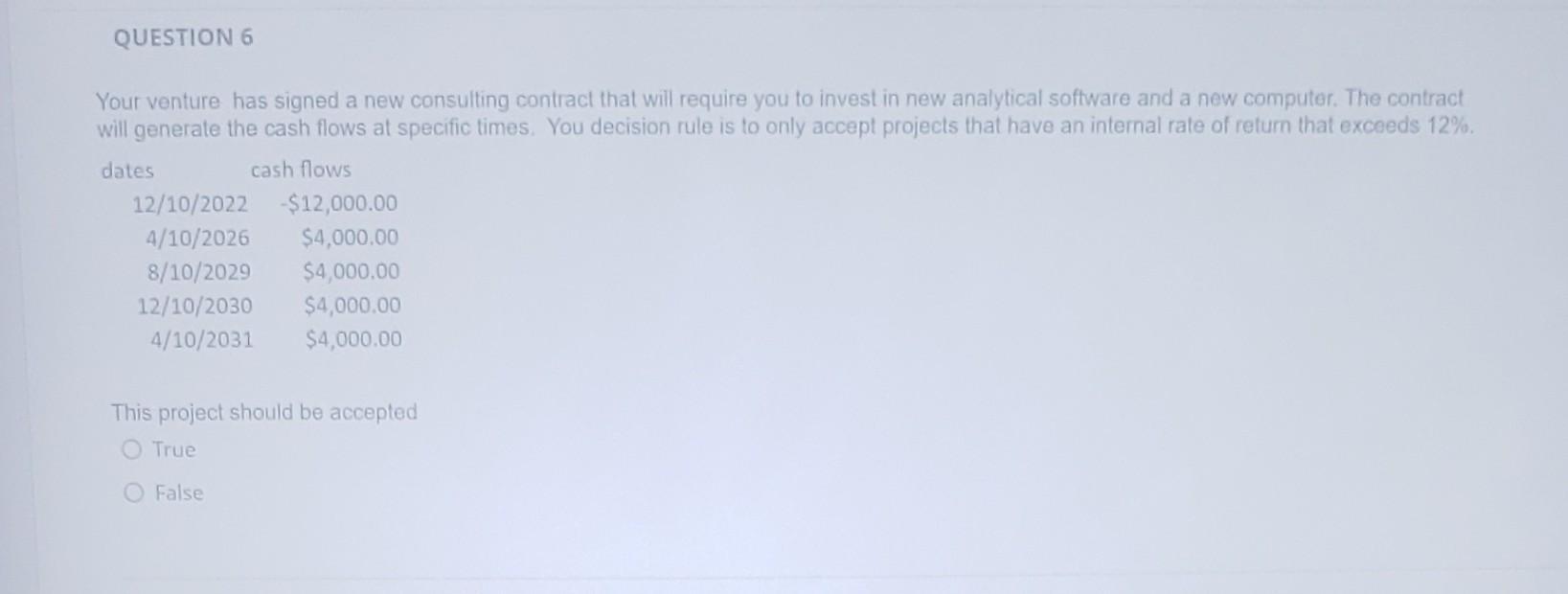

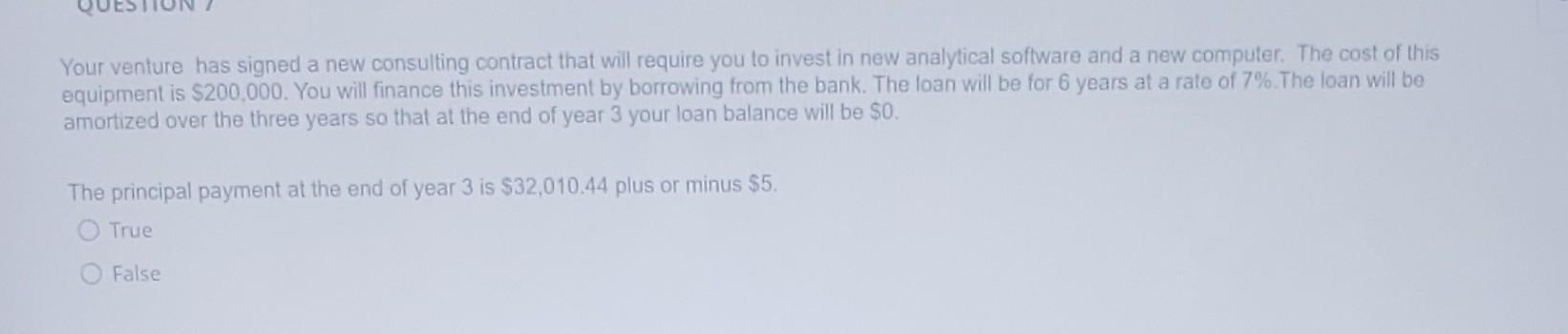

Your venture has signed a new consulting contract that will require you to invest in new analytical software and a new computer. The contract will generate the following periodic cash flows. You have used bank credit to finance the cost of the software and hardware. The financing rate is 6%. Cash flows generated from the project will be reinvested at 4%. The MIRR of the project is between 6% and 7%. time cash flow 0-$200,000 1 $20,000 2 $30,000 3 $50,000 4 $65,000 5 $80,000 True False QUESTION 6 Your venture has signed a new consulting contract that will require you to invest in new analytical software and a new computer. The contract will generate the cash flows at specific times. You decision rule is to only accept projects that have an internal rate of return that exceeds 12%. dates cash flows 12/10/2022 $12,000.00 4/10/2026 $4,000.00 8/10/2029 $4,000.00 12/10/2030 $4,000.00 4/10/2031 $4,000.00 This project should be accepted True O False Your venture has signed a new consulting contract that will require you to invest in new analytical software and a new computer. The cost of this equipment is $200,000. You will finance this investment by borrowing from the bank. The loan will be for 6 years at a rate of 7%. The loan will be amortized over the three years so that at the end of year 3 your loan balance will be $0. The principal payment at the end of year 3 is $32,010.44 plus or minus $5. True False

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

False The MIRR of the project is not between 6 and 7 Th... View full answer

Get step-by-step solutions from verified subject matter experts