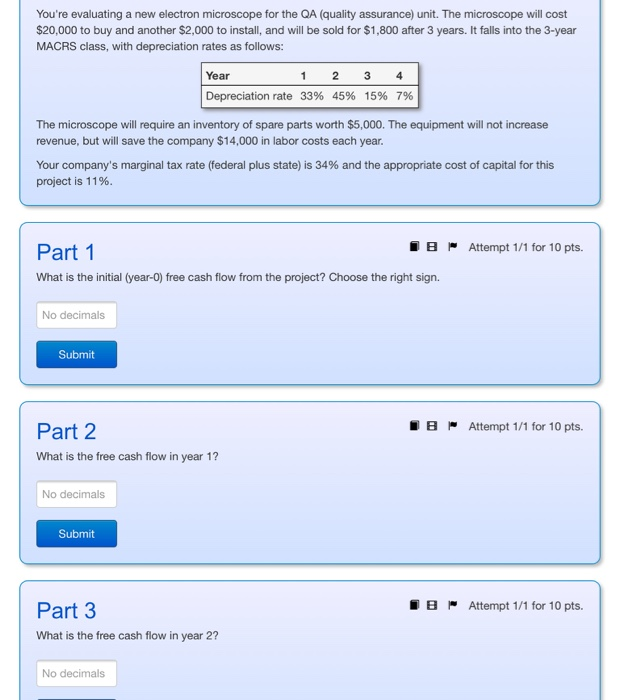

Question: You're evaluating a new electron microscope for the QA (quality assurance) unit. The microscope will cost $20,000 to buy and another $2,000 to install, and

You're evaluating a new electron microscope for the QA (quality assurance) unit. The microscope will cost $20,000 to buy and another $2,000 to install, and will be sold for $1,800 after 3 years. It falls into the 3-year MACRS class, with depreciation rates as follows: Year Depreciation rate 33% 45% 15% 7% The microscope will require an inventory of spare parts worth $5,000. The equipment will not increase revenue, but will save the company $14,000 in labor costs each year. Your company's marginal tax rate (federal plus state) is 34% and the appropriate cost of capital for this project is 1 1 %. BAttempt 1/1 for 10 pts. Part 1 What is the initial (year-0) free cash flow from the project? Choose the right sign. No decimals Submit 8 Attempt 1/1 for 10 pts. Part 2 What is the free cash flow in year 1? No decimals Submit 8 Part 3 What is the free cash flow in year 2? - Attempt 1 /1 for 10 pts. No decimals Part 4 What is the after-tax salvage value at the end of year 3? 8 - Attempt 1 /1 for 10 pts No decimals Submit HAttempt 1/1 for 10 pts Part 5 What is the free cash flow in year 3? No decimals Submit ] 8 Part 6 - Attempt 1 /1 for 10 pts. What is the NPV of this project? No decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts