Question: zakeAssignment/takeAssignmentan.co INVULLE eBook Show Me How Calculator Print Item Current abilities New Wave Co. sold 15,000 annual subscriptions of Game Life for $54 during December

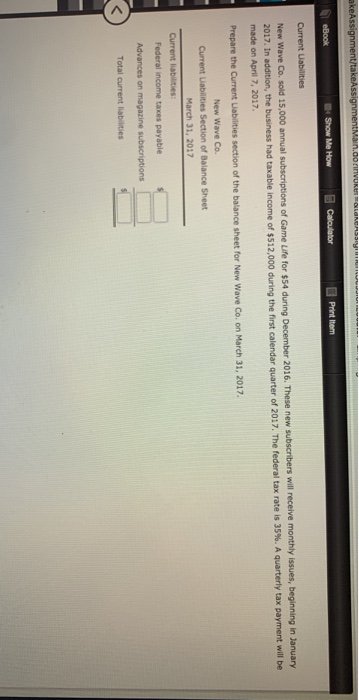

zakeAssignment/takeAssignmentan.co INVULLE eBook Show Me How Calculator Print Item Current abilities New Wave Co. sold 15,000 annual subscriptions of Game Life for $54 during December 2016. These new subscribers will receive monthly issues, beginning in January 2017. In addition, the business had taxable income of $512,000 during the first calendar quarter of 2017. The federal tax rate is 35%. A quarterly tax payment will be made on April 7, 2017 Prepare the Current Liabilities section of the balance sheet for New Wave Co. on March 31, 2017. New Wave Co. Current Uabilities Section of Balance Sheet March 31, 2017 Current liabilities: Federal income taxes payable Advances on magazine subscriptions Total current liabilities zakeAssignment/takeAssignmentan.co INVULLE eBook Show Me How Calculator Print Item Current abilities New Wave Co. sold 15,000 annual subscriptions of Game Life for $54 during December 2016. These new subscribers will receive monthly issues, beginning in January 2017. In addition, the business had taxable income of $512,000 during the first calendar quarter of 2017. The federal tax rate is 35%. A quarterly tax payment will be made on April 7, 2017 Prepare the Current Liabilities section of the balance sheet for New Wave Co. on March 31, 2017. New Wave Co. Current Uabilities Section of Balance Sheet March 31, 2017 Current liabilities: Federal income taxes payable Advances on magazine subscriptions Total current liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts