Question: Zanatech's market for its remote control has changed significantly, and Zanatech has had to drop the selling price per unit from $45 to $38. There

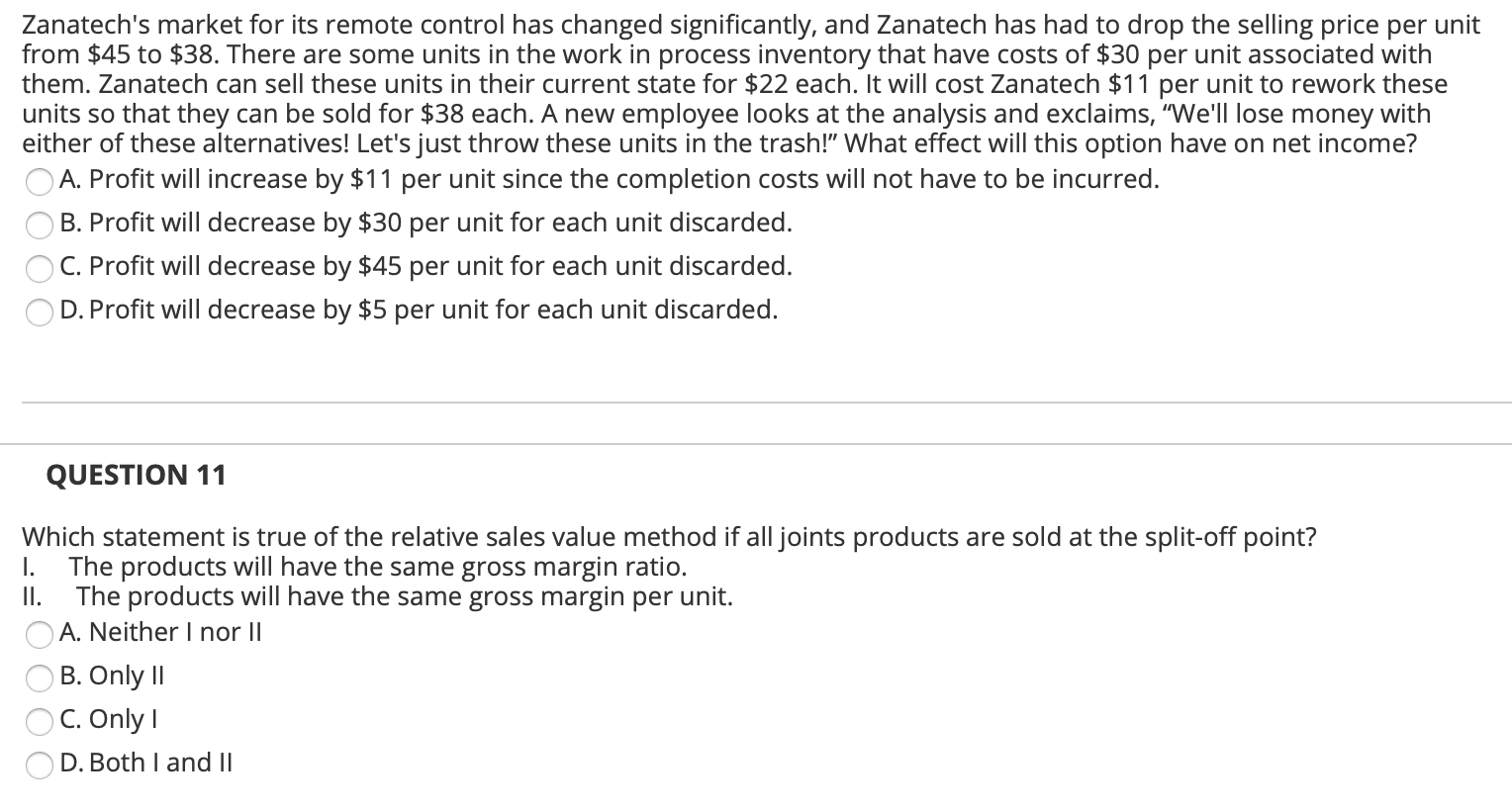

Zanatech's market for its remote control has changed significantly, and Zanatech has had to drop the selling price per unit from $45 to $38. There are some units in the work in process inventory that have costs of $30 per unit associated with them. Zanatech can sell these units in their current state for $22 each. It will cost Zanatech $11 per unit to rework these units so that they can be sold for $38 each. A new employee looks at the analysis and exclaims, 'We'll lose money with either of these alternatives! Let's just throw these units in the trash!" What effect will this option have on net income? A. Profit will increase by $11 per unit since the completion costs will not have to be incurred. B. Profit will decrease by $30 per unit for each unit discarded. C. Profit will decrease by $45 per unit for each unit discarded. D. Profit will decrease by $5 per unit for each unit discarded. QUESTION 11 Which statement is true of the relative sales value method if all joints products are sold at the split-off point? 1. The products will have the same gross margin ratio. II. The products will have the same gross margin per unit. A. Neither I nor || B. Only 11 C. Only ! D. Both I and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts