Question: Scenario Analysis Scenario analysis is used to determine the range of possible outcomes for a project. Typically, the base case, best case, and worst case

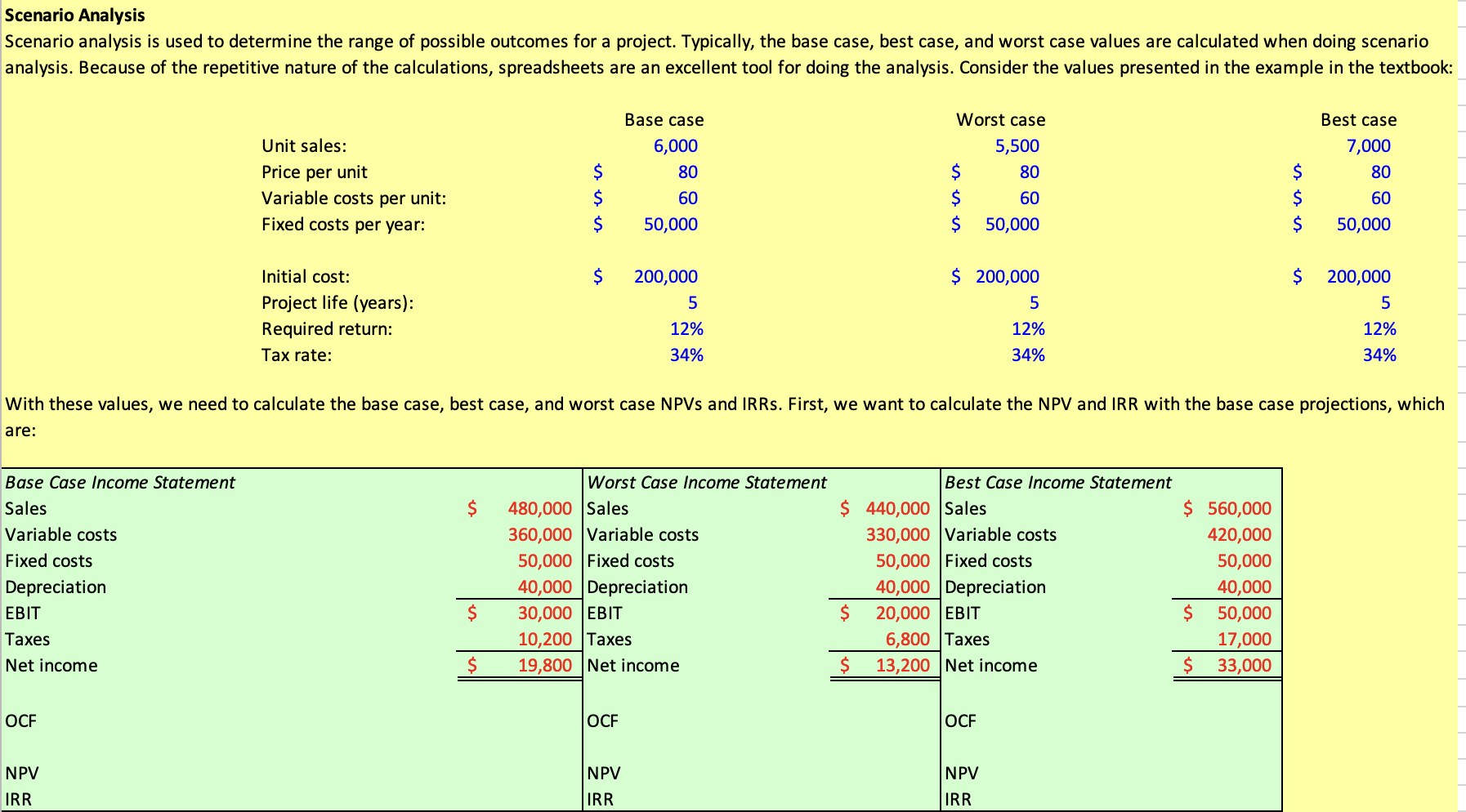

Scenario Analysis Scenario analysis is used to determine the range of possible outcomes for a project. Typically, the base case, best case, and worst case values are calculated when doing scenario analysis. Because of the repetitive nature of the calculations, spreadsheets are an excellent tool for doing the analysis. Consider the values presented in the example in the textbook: Unit sales: Price per unit Variable costs per unit: Fixed costs per year: $ Base case 6,000 80 60 50,000 $ $ $ Worst case 5,500 80 $ 60 $ 50,000 $ $ $ Best case 7,000 80 60 50,000 $ $ Initial cost: Project life (years): Required return: Tax rate: 200,000 5 12% $ 200,000 5 12% 34% 200,000 5 12% 34% 34% With these values, we need to calculate the base case, best case, and worst case NPVs and IRRs. First, we want to calculate the NPV and IRR with the base case projections, which are: $ Base Case Income Statement Sales Variable costs Fixed costs Depreciation EBIT Taxes Net income Worst Case Income Statement 480,000 Sales 360,000 Variable costs 50,000 Fixed costs 40,000 Depreciation 30,000 EBIT 10,200 Taxes 19,800 Net income Best Case Income Statement $ 440,000 Sales $ 560,000 330,000 Variable costs 420,000 50,000 Fixed costs 50,000 40,000 Depreciation 40,000 $ 20,000 EBIT $ 50,000 6,800 Taxes 17,000 $ 13,200 Net income $ 33,000 $ $ OCF OCF OCF NPV NPV IRR NPV IRR IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts