Question: Zeon, a large profitable corporation, is considering adding some automatic equipment in its production facilities. An investment of ( $ 3 0 0

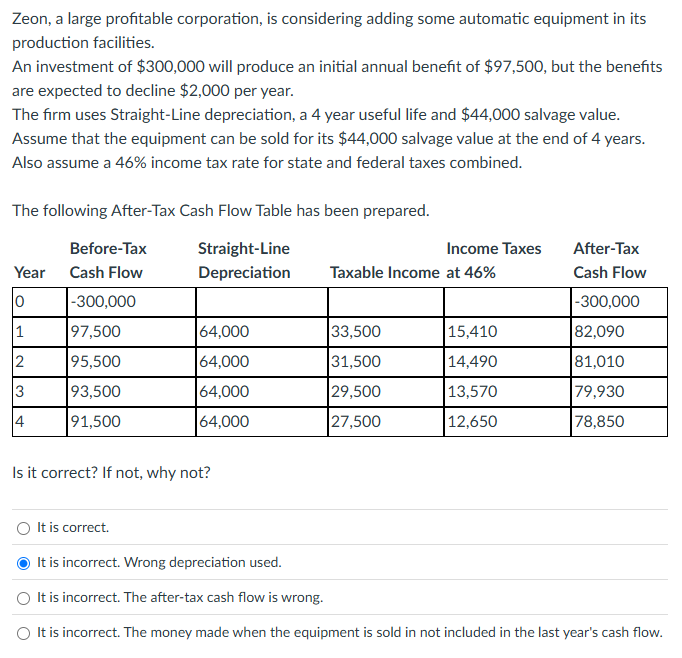

Zeon, a large profitable corporation, is considering adding some automatic equipment in its production facilities.

An investment of $ will produce an initial annual benefit of $ but the benefits are expected to decline $ per year.

The firm uses StraightLine depreciation, a year useful life and $ salvage value.

Assume that the equipment can be sold for its $ salvage value at the end of years.

Also assume a income tax rate for state and federal taxes combined.

The following AfterTax Cash Flow Table has been prepared.

begintabularllllll

& multicolumncbegintabularc

BeforeTax

Year

endtabular & begintabularc

StraightLine

Cash Flow

endtabular & multicolumncbegintabularc

Income Taxes

Depreciation

endtabular & multicolumncbegintabularl

AfterTax

Taxable Income at

endtabular

hline & & & & &

hline & & & & &

hline & & & & &

hline & & & & &

hline & & & & &

hline

endtabular

Is it correct? If not, why not?

It is correct.

It is incorrect. Wrong depreciation used.

It is incorrect. The aftertax cash flow is wrong.

It is incorrect. The money made when the equipment is sold in not included in the last year's cash flow.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock