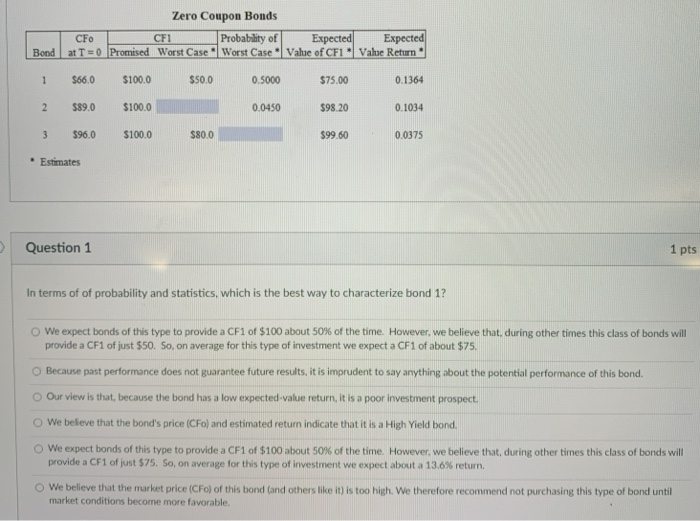

Question: Zero Coupon Bonds CFo CF1 Probability of Expected Expected at T = 0 Promised Worst Case Worst Case Value of CFI Value Return Bond 1

Zero Coupon Bonds CFo CF1 Probability of Expected Expected at T = 0 Promised Worst Case Worst Case Value of CFI Value Return Bond 1 $66.0 $100.0 $50.0 0.5000 $75.00 0.1364 2 $89.0 $100.0 0.0450 $98.20 0.1034 3 $96.0 $100.0 $800 $99.60 0.0375 * Estimates > Question 1 1 pts In terms of of probability and statistics, which is the best way to characterize bond 1? We expect bonds of this type to provide a CF1 of $100 about 50% of the time. However, we believe that, during other times this class of bonds will provide a CF1 of just $50. So, on average for this type of investment we expect a CF1 of about $75. Because past performance does not guarantee future results, it is imprudent to say anything about the potential performance of this bond. Our view is that, because the bond has a low expected-value return, it is a poor investment prospect. We believe that the bond's price (CFo) and estimated return indicate that it is a High Yield bond. We expect bonds of this type to provide a CF1 of $100 about 50% of the time. However, we believe that, during other times this class of bonds will provide a CF 1 of just $75. So, on average for this type of investment we expect about a 13.6% return We believe that the market price (CF) of this bond (and others like it is too high. We therefore recommend not purchasing this type of bond until market conditions become more favorable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts