Question: Zeus plc previously borrowed 20 million over a 9-year term. At the time of the borrowing, the company had been wary of interest rates increasing

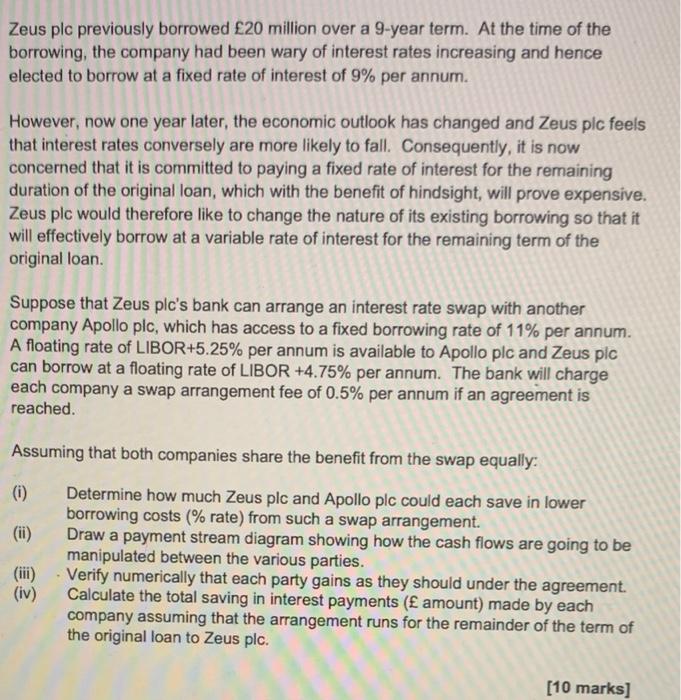

Zeus plc previously borrowed 20 million over a 9-year term. At the time of the borrowing, the company had been wary of interest rates increasing and hence elected to borrow at a fixed rate of interest of 9% per annum. However, now one year later, the economic outlook has changed and Zeus pic feels that interest rates conversely are more likely to fall. Consequently, it is now concerned that it is committed to paying a fixed rate of interest for the remaining duration of the original loan, which with the benefit of hindsight, will prove expensive. Zeus plc would therefore like to change the nature of its existing borrowing so that it will effectively borrow at a variable rate of interest for the remaining term of the original loan. Suppose that Zeus plc's bank can arrange an interest rate swap with another company Apollo plc, which has access to a fixed borrowing rate of 11% per annum. A floating rate of LIBOR+5.25% per annum is available to Apollo plc and Zeus plc can borrow at a floating rate of LIBOR +4.75% per annum. The bank will charge each company a swap arrangement fee of 0.5% per annum if an agreement is reached. Assuming that both companies share the benefit from the swap equally: (1) Determine how much Zeus plc and Apollo plc could each save in lower borrowing costs (% rate) from such a swap arrangement. Draw a payment stream diagram showing how the cash flows are going to be manipulated between the various parties. Verify numerically that each party gains as they should under the agreement. Calculate the total saving in interest payments ( amount) made by each company assuming that the arrangement runs for the remainder of the term of the original loan to Zeus plc. (iii) (iv) [10 marks] Zeus plc previously borrowed 20 million over a 9-year term. At the time of the borrowing, the company had been wary of interest rates increasing and hence elected to borrow at a fixed rate of interest of 9% per annum. However, now one year later, the economic outlook has changed and Zeus pic feels that interest rates conversely are more likely to fall. Consequently, it is now concerned that it is committed to paying a fixed rate of interest for the remaining duration of the original loan, which with the benefit of hindsight, will prove expensive. Zeus plc would therefore like to change the nature of its existing borrowing so that it will effectively borrow at a variable rate of interest for the remaining term of the original loan. Suppose that Zeus plc's bank can arrange an interest rate swap with another company Apollo plc, which has access to a fixed borrowing rate of 11% per annum. A floating rate of LIBOR+5.25% per annum is available to Apollo plc and Zeus plc can borrow at a floating rate of LIBOR +4.75% per annum. The bank will charge each company a swap arrangement fee of 0.5% per annum if an agreement is reached. Assuming that both companies share the benefit from the swap equally: (1) Determine how much Zeus plc and Apollo plc could each save in lower borrowing costs (% rate) from such a swap arrangement. Draw a payment stream diagram showing how the cash flows are going to be manipulated between the various parties. Verify numerically that each party gains as they should under the agreement. Calculate the total saving in interest payments ( amount) made by each company assuming that the arrangement runs for the remainder of the term of the original loan to Zeus plc. (iii) (iv) [10 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts