Question: ZipCo is developing a platform for renters that requires successful development of two important components. Component Y is expected to require an upfront investment of

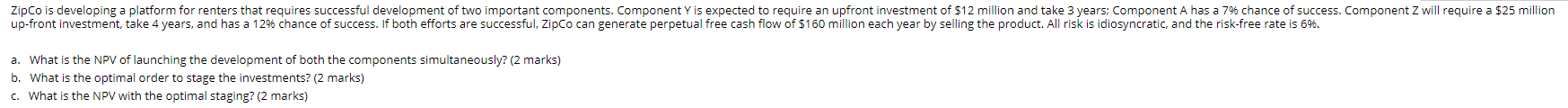

ZipCo is developing a platform for renters that requires successful development of two important components. Component Y is expected to require an upfront investment of $12 million and take 3 years: Component A has a 7% chance of success. Component Z will require a $25 million up-front investment, take 4 years, and has a 12% chance of success. If both efforts are successful, ZipCo can generate perpetual free cash flow of $160 million each year by selling the product. All risk is idiosyncratic, and the risk-free rate is 6%. a. What is the NPV of launching the development of both the components simultaneously? (2 marks) b. What is the optimal order to stage the investments? (2 marks) C. What is the NPV with the optimal staging? (2 marks) ZipCo is developing a platform for renters that requires successful development of two important components. Component Y is expected to require an upfront investment of $12 million and take 3 years: Component A has a 7% chance of success. Component Z will require a $25 million up-front investment, take 4 years, and has a 12% chance of success. If both efforts are successful, ZipCo can generate perpetual free cash flow of $160 million each year by selling the product. All risk is idiosyncratic, and the risk-free rate is 6%. a. What is the NPV of launching the development of both the components simultaneously? (2 marks) b. What is the optimal order to stage the investments? (2 marks) C. What is the NPV with the optimal staging? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts