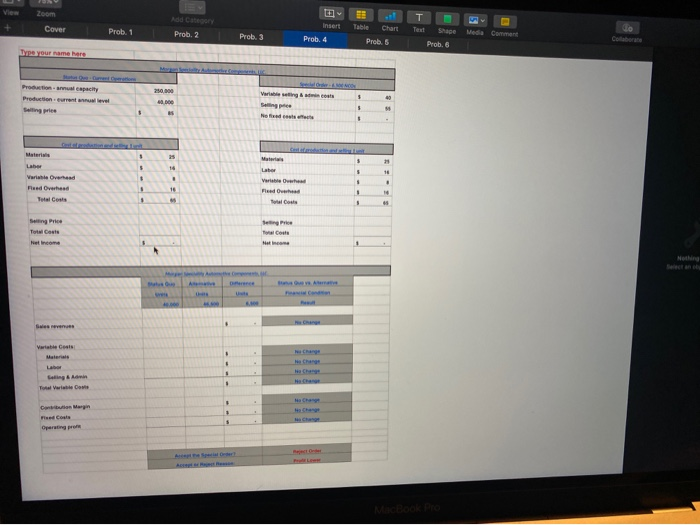

Question: Zoom Insert Cover Table Prob. 1 Chant Prob. 2 Prob. 3 Media Text Srce Prob. 6 Comment Prob. 4 Prob. Do your name here 250.000

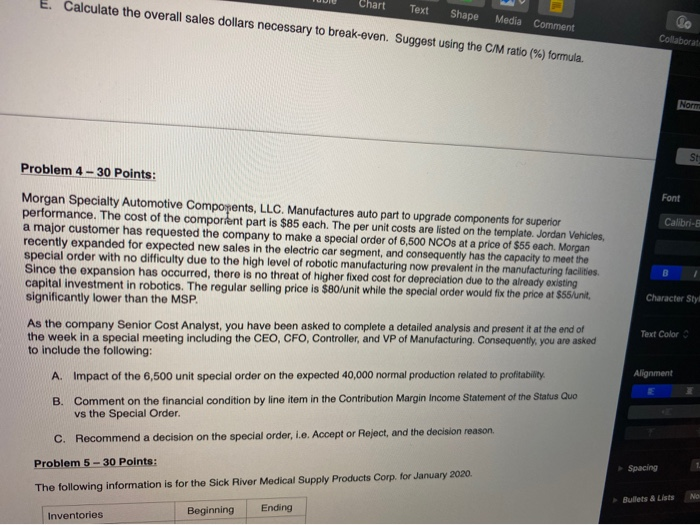

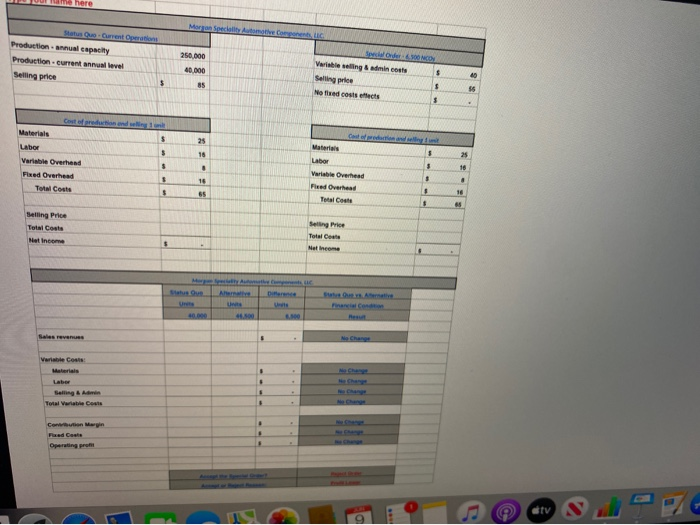

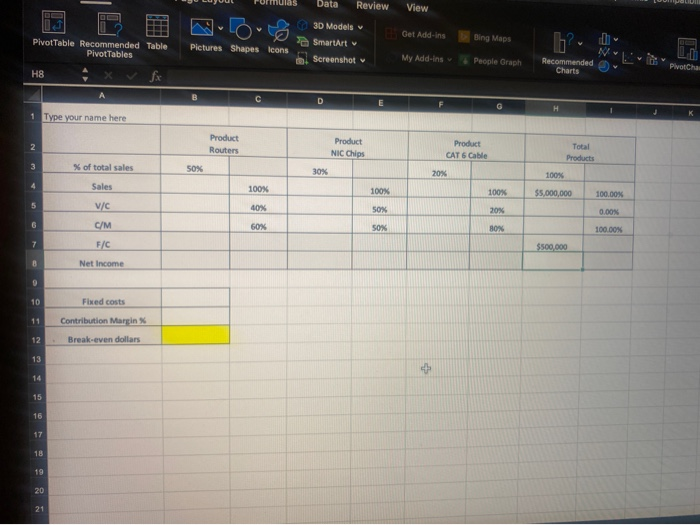

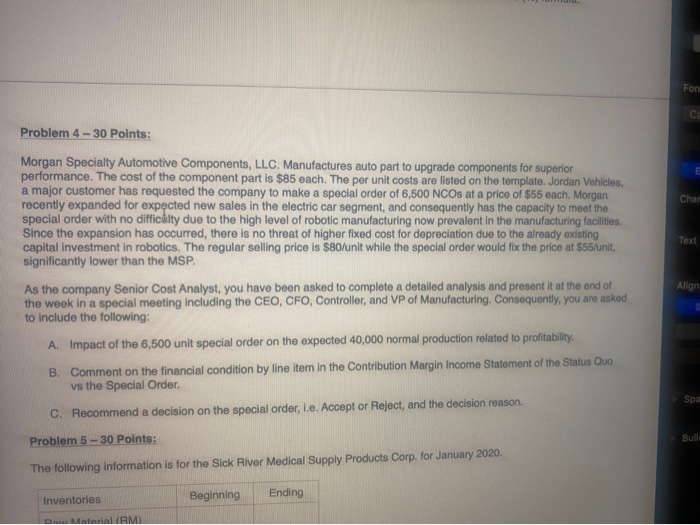

Zoom Insert Cover Table Prob. 1 Chant Prob. 2 Prob. 3 Media Text Srce Prob. 6 Comment Prob. 4 Prob. Do your name here 250.000 Protopacity Production current level Singe $ 5 5 25 Lab $ 16 Labor 10 . Variable Overhead Feed Overhead Total Costa . 16 . 8 . FO Toulous To Costa come Change The Costa E. Calculate the overall sales dollars necessary to break-even. Suggest using the C/M ratio (%) formula. Chart Text Shape Media Comment Collaborate Norm s Problem 4-30 Points: Font Calibri- Character Styl Morgan Specialty Automotive Compopents, LLC. Manufactures auto part to upgrade components for superior performance. The cost of the comportant part is $85 each. The per unit costs are listed on the template. Jordan Vehicles, a major customer has requested the company to make a special order of 6,500 NCOs at a price of $55 each. Morgan recently expanded for expected new sales in the electric car segment, and consequently has the capacity to meet the special order with no difficulty due to the high level of robotic manufacturing now prevalent in the manufacturing facilities Since the expansion has occurred, there is no threat of higher fixed cost for depreciation due to the already existing capital investment in robotics. The regular selling price is $80/unit while the special order would fix the price at $55/unit, significantly lower than the MSP. As the company Senior Cost Analyst, you have been asked to complete a detailed analysis and present it at the end of the week in a special meeting including the CEO, CFO, Controller, and VP of Manufacturing. Consequently, you are asked to include the following: A. Impact of the 6,500 unit special order on the expected 40,000 normal production related to profitability. B. Comment on the financial condition by line item in the Contribution Margin Income Statement of the Status Quo vs the Special Order. c. Recommend a decision on the special order, i.e. Accept or Reject, and the decision reason. Text Color Alignment Problem 5-30 Points: Spacing The following information is for the Sick River Medical Supply Products Corp. for January 2020 NO Bullets & Lists Inventories Beginning Ending here Production annual capacity Production. Current level Selling price 250.000 40.000 $ 4 Variable selling in costs Selling price Noted costs efects 5 AS $ $ $ 25 $ 16 S 25 Materials Labor Variable Overhead Fixed Overhead Total Costs LA $ 8 $ 18 1 1 16 . Variable Overhead Feed Overhead Total Co $ . $ Selling Price Total Costa Net Income Selling Price Total Costa Nel income 6.100 Hes Sales revenue Variable Co Materials 1 . + . Fixed Con Operating pro tv Data MOLL Review View Y Get Add-ins PivotTable Recommended Table Pivot Tables Bing Maps 3D Models SmartArt Screenshot Pictures Shapes Icons My Add-ins People Graph Recommended Charts Pivotcha H8 D E K Type your name here Product Routers Product 2 NIC Chips Product CAT 6 Cable Total Products 3 % of total sales 50% 30% 20% 100% Sales 100% 100% 100% $5,000,000 100.00% 5 V/C 40% 50% 20% 0.00% C/M 60% SOX BOX 100.00N 7 F/C $500,000 Net Income 10 Fixed costs 11 Contribution Martin 12 Break-even dollars 13 14 15 16 17 18 19 20 21 Fon Problem 4-30 Points: Char Text Morgan Specialty Automotive Components, LLC. Manufactures auto part to upgrade components for superior performance. The cost of the component part is $85 each. The per unit costs are listed on the template. Jordan Vehicles, a major customer has requested the company to make a special order of 6,500 NCOs at a price of $55 each. Morgan recently expanded for expected new sales in the electric car segment, and consequently has the capacity to meet the special order with no diffickly due to the high level of robotic manufacturing now prevalent in the manufacturing facilities. Since the expansion has occurred, there is no threat of higher fixed cost for depreciation due to the already existing capital investment in robotics. The regular selling price is $80/unit while the special order would fix the price at $55/unit, significantly lower than the MSP. As the company Senior Cost Analyst, you have been asked to complete a detailed analysis and present it at the end of the week in a special meeting including the CEO, CFO, Controller, and VP of Manufacturing. Consequently, you are asked to include the following: A. Impact of the 6,500 unit special order on the expected 40,000 normal production related to profitability, B. Comment on the financial condition by line item in the Contribution Margin Income Statement of the Status Quo vs the Special Order. Align Spa C. Recommend a decision on the special order, i.e. Accept or Reject, and the decision reason. Problem 5 - 30 Points: Bulli The following information is for the Sick River Medical Supply Products Corp. for January 2020, Inventories Beginning Ending Material (RM) Zoom Insert Cover Table Prob. 1 Chant Prob. 2 Prob. 3 Media Text Srce Prob. 6 Comment Prob. 4 Prob. Do your name here 250.000 Protopacity Production current level Singe $ 5 5 25 Lab $ 16 Labor 10 . Variable Overhead Feed Overhead Total Costa . 16 . 8 . FO Toulous To Costa come Change The Costa E. Calculate the overall sales dollars necessary to break-even. Suggest using the C/M ratio (%) formula. Chart Text Shape Media Comment Collaborate Norm s Problem 4-30 Points: Font Calibri- Character Styl Morgan Specialty Automotive Compopents, LLC. Manufactures auto part to upgrade components for superior performance. The cost of the comportant part is $85 each. The per unit costs are listed on the template. Jordan Vehicles, a major customer has requested the company to make a special order of 6,500 NCOs at a price of $55 each. Morgan recently expanded for expected new sales in the electric car segment, and consequently has the capacity to meet the special order with no difficulty due to the high level of robotic manufacturing now prevalent in the manufacturing facilities Since the expansion has occurred, there is no threat of higher fixed cost for depreciation due to the already existing capital investment in robotics. The regular selling price is $80/unit while the special order would fix the price at $55/unit, significantly lower than the MSP. As the company Senior Cost Analyst, you have been asked to complete a detailed analysis and present it at the end of the week in a special meeting including the CEO, CFO, Controller, and VP of Manufacturing. Consequently, you are asked to include the following: A. Impact of the 6,500 unit special order on the expected 40,000 normal production related to profitability. B. Comment on the financial condition by line item in the Contribution Margin Income Statement of the Status Quo vs the Special Order. c. Recommend a decision on the special order, i.e. Accept or Reject, and the decision reason. Text Color Alignment Problem 5-30 Points: Spacing The following information is for the Sick River Medical Supply Products Corp. for January 2020 NO Bullets & Lists Inventories Beginning Ending here Production annual capacity Production. Current level Selling price 250.000 40.000 $ 4 Variable selling in costs Selling price Noted costs efects 5 AS $ $ $ 25 $ 16 S 25 Materials Labor Variable Overhead Fixed Overhead Total Costs LA $ 8 $ 18 1 1 16 . Variable Overhead Feed Overhead Total Co $ . $ Selling Price Total Costa Net Income Selling Price Total Costa Nel income 6.100 Hes Sales revenue Variable Co Materials 1 . + . Fixed Con Operating pro tv Data MOLL Review View Y Get Add-ins PivotTable Recommended Table Pivot Tables Bing Maps 3D Models SmartArt Screenshot Pictures Shapes Icons My Add-ins People Graph Recommended Charts Pivotcha H8 D E K Type your name here Product Routers Product 2 NIC Chips Product CAT 6 Cable Total Products 3 % of total sales 50% 30% 20% 100% Sales 100% 100% 100% $5,000,000 100.00% 5 V/C 40% 50% 20% 0.00% C/M 60% SOX BOX 100.00N 7 F/C $500,000 Net Income 10 Fixed costs 11 Contribution Martin 12 Break-even dollars 13 14 15 16 17 18 19 20 21 Fon Problem 4-30 Points: Char Text Morgan Specialty Automotive Components, LLC. Manufactures auto part to upgrade components for superior performance. The cost of the component part is $85 each. The per unit costs are listed on the template. Jordan Vehicles, a major customer has requested the company to make a special order of 6,500 NCOs at a price of $55 each. Morgan recently expanded for expected new sales in the electric car segment, and consequently has the capacity to meet the special order with no diffickly due to the high level of robotic manufacturing now prevalent in the manufacturing facilities. Since the expansion has occurred, there is no threat of higher fixed cost for depreciation due to the already existing capital investment in robotics. The regular selling price is $80/unit while the special order would fix the price at $55/unit, significantly lower than the MSP. As the company Senior Cost Analyst, you have been asked to complete a detailed analysis and present it at the end of the week in a special meeting including the CEO, CFO, Controller, and VP of Manufacturing. Consequently, you are asked to include the following: A. Impact of the 6,500 unit special order on the expected 40,000 normal production related to profitability, B. Comment on the financial condition by line item in the Contribution Margin Income Statement of the Status Quo vs the Special Order. Align Spa C. Recommend a decision on the special order, i.e. Accept or Reject, and the decision reason. Problem 5 - 30 Points: Bulli The following information is for the Sick River Medical Supply Products Corp. for January 2020, Inventories Beginning Ending Material (RM)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts