The best trick this season wont be done on skis or a board, it will be worn.

Question:

“The best trick this season won’t be done on skis or a board, it will be worn.” SnowSports Interactive (SSI) executives felt that phrase appropriately described the new technology they were planning to introduce to the world of the ski industry in the winter of 2006–2007. However, in June 2006, the company confronted a number of challenges. What, executives wondered, did they need to do to maximize the potential for their company?

History of the Company

SSI was born over a beer at a conference in Melbourne, Australia, in January 2004. Company founders Steve Kenny and Shubber Ali quickly envisioned their initial product as a skier tracker system. During 2004, Kenny completed an analysis of the global ski industry. He identified key gaps in the market and the combination of technologies available to fill them. In May 2005, SSI was legally born with Kenny as CEO and Ali as Chairman.

The company’s core intellectual property combined the latest positioning, wireless, and identification technologies with proprietary tracking and analysis software. In simple English, SSI technology could locate people and assets at any ski resort in the world where the company’s technology was installed.

The company was located in Brisbane, Australia, and became an i.Lab member in November 2005. The i.Lab was part of the Queensland government’s new Statewide Technology Incubation Strategy. Location in the i.Lab provided the company with the opportunity to work with some of the leading business minds in Queensland and Australia.

Nurturing, mentoring, and resources from i.Lab helped the company reach the next stage/level.

The Product and Services

From 2004 through spring 2006, SSI associates concentrated on product design and technology development. The company called its initial product, a small lightweight tag worn by skiers and snowboarders, the Flaik (Exhibit 1). The Flaik device included multiple technologies, including GPS units to continuously monitor the position and time of users and GSM communications units to transmit position and time data to a network operating center.

In March 2006, SSI and Mt. Buller Alpine Resort agreed to a beta test of SSI technology. The Mt. Buller Alpine Resort was located near Melbourne and was the fourth largest among Australia’s five major ski resorts. SSI provided both tracking technology and the firm’s wireless Internet service called whispar™ at Mt. Buller. The partners used a significant proportion of available funds to install the wireless system. SSI established an on-site office for company personnel who dealt directly with customers and observed firsthand how the technology operated on the slopes. The system came into operation on June 9, 2006, and the beta test ran successfully during the 2006 season. Sales of the whispar system increased daily during the first month of operation and continued a favorable growth pattern.

SSI executives wanted to dramatically enhance the experience of skiers, snowboarders, and downhill sliders worldwide. The company had developed extensive intellectual property combining the latest in GPS, Wi-Fi, and RFID technologies with proprietary tracking and analysis software. When asked what the company’s competitive advantage was, an SSI representative responded, “The SSI advantage is simple. We provide a simple, compelling user experience through the integration of the latest technology with unique, proprietary applications and services, all in a sleek package with a simple user interface.”

The Flaik would be another accessory offering for the skier. Accessories, apparel, and apparel accessories were a must on the slopes. Among items that had been popular in recent years were anti-outerwear, urban influences for edgy looks, hip in the city, hip on the slopes, denim in snowboard pants, synthetic leather pants, prints like zebra, military fatigues, great fitting clothes for women, pockets with CD players, and avalanche devices in garments for backcountry (see Exhibit 1).

The Industry

The snow sports industry comprised many facets, including manufacturing, retailing, resort development, and tourism. The industry’s success was dependent on an often fickle Mother Nature—that is, on whether the season had

sufficient snow. The snow season was different on the five populated continents, and SSI would need to adapt its business model accordingly.

Snow depth was considered very important in the skiing industry because it determined whether a ski resort stayed open or not, the amount of operational days within a season, and the number of lifts operating within the season.

The industry reported that the 2003–2004 ski season was the third best season ever in terms of skier visits despite persistent negative factors such as a slowly rebounding international economy, a jobless recovery in many sectors of the economy, high gas prices, muted consumer confidence levels, and international tensions.

The snow sports industry was primarily known for its skiing, snowboarding, and cross-country skiing. In the United States, the demand for alpine ski lessons had increased, with a 1.1% increase between 2002–03 and 2003–04 (from 17,935 lessons in 2002–03 to 18,135 in 2003–04). The number of snowboard lessons had a smaller increase of 0.2% (from 6,101 in 2002–03 to 6,113 in 2003–04).

A new sport that had become recently popular was New School—a youth movement about music, festivals, and action sports. The movement was a fusion of snowboarding, skiing, skateboarding, bike stunt riding, motocross, and surfing. The movement was hot with those 12 to 16 years of age. Another sport that had become popular was telemark skiing, where downhill skiers “floated” down the mountain with their heels unattached. Telemark skiers mostly accessed backcountry because it offered freedom and untouched powder for advanced skiers who wanted to push their limits.

The industry had created many innovative products and experienced significant gains in women’s and children’s equipment and apparel stores. The industry recognized that it heavily relied on affluent but aging baby boomers.

However, the industry was also marketing itself to Generation Y (Gen Y). The Gen Y group was defined as those born immediately after Generation X (Gen X), those born in the 20th century. Thus, Gen Y included people in their early and mid 20s, teenagers, and children over age five. The term Gen Y was most popularly used in the United States, but its use had gone far beyond there and thus came to refer to the youth throughout the Anglophone world.

The Gen Y age group was more diverse than previous generations. For example, 40% of those 16 to 24 years of age were not Caucasian.

In the United States, the snow sports industry was governed by SnowSports Industries America (SIA). SIA was a national, not-for-profit, member-owned trade association of competing snow sports companies. Its membership was open to product manufacturers, distributors, suppliers, and retail shops. Service providers, including Internet and web designers, could be involved through limited memberships. SIA was known for its comprehensive report on the global skiing market.

The industry also included manufacturers, importers, distributors, and retail suppliers of equipment, apparel, and accessories.

Some of these companies were divisions of major corporations listed on the New York Stock Exchange. Others were small, independent companies. The greatest strength of the independent companies lay in their ability to innovate in the design of new products, products that were constantly giving skiers and riders fresh reasons to hit the slopes.

In the United States alone, there were 8,500 retailers and other companies that offered winter sports products for sale, rental, use as promotions, and use for professional purposes. Out of that 8,500, about 2,000 were specialty and chain stores that sold apparel or accessories related to winter sports but were not what would be called a ski and snowboard shop.

The consumer profile of the snow sports industry continued to exhibit stability with many visitor characteristics and gradually shifted with others. Among the most prominent shifts were the continued aging of the visitor base and a related increase in experience in snow sports. There are also signs of gradual increase in participation by children in the 10–14 and 15–17 age groups, first-timers and beginners, and different races and ethnicities.

Currently, SSI’s main competitors for the Flaik included NASTAR, Slope Tracker, Suunto, and NAVMAN. SSI identified its competitive advantage in real-time remote monitoring, the ability to locate friends, and safety applications. SSI’s potential competition came from two main streams—namely, recreational GPS receiver and sports tool manufacturers and recreational snow sports analysis service providers. However, SSI executives felt they were differentiating themselves as a company that would provide customers a low-cost, easy-to-use service with functionality that far outstripped that provided by existing manufacturers and service providers.

The Financial Situation

One of the challenges SSI as a global start-up continued to face in mid-2006 was how to finance growth and capitalize on its current greenfield opportunity presented by the lack of dedicated ski-tracking companies. SSI was initially funded by Kenny and Ali. The two founders then relied on a round of financing provided by “three F’s” (family, friends, and fools).

In mid-2006, SSI was in the process of placing a round for US$1.5 million at US$3.50 a share (i.e., a company valuation of US$6.06 million). The company had recruited Mike Wallas, CEO of Enterprise Growth Solutions, to secure this round from a combination of high-net-worth individuals, investment groups, and venture capitalists. The company had also secured government funding through Commercializing Emerging Technologies (COMET) and was currently preparing grant applications for Commercial Ready, the Queensland Innovation Start-Up Scheme, and the (Australian) federal government’s Export

Market Development Grant.

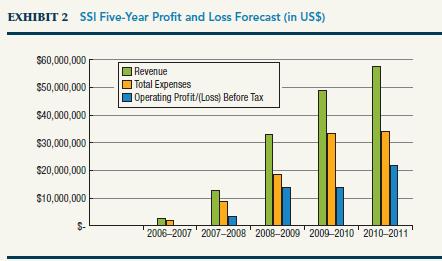

Most experts identify financial issues as among global start-ups’ major challenges. SSI executives agreed. The company’s five-year profit and loss forecast is presented in Exhibit 2.

The Company Strategy

SSI identified five potential revenue sources in its business model: ski school applications, user applications, resortmanagement applications, sponsorship and advertising, and wireless Internet.

A tentative global strategy SSI had adopted to raise funds involved creating partnerships with ski resorts. SSI executives envisioned approaching target markets for expressions of interest. Each partnership would involve creating a limited liability company with a ski resort company. The limited liability company would be operated by a combination of the existing SSI Australian team and a local team. SSI executives identified the benefits offered to the resort itself as well as to the users of the system. These benefits included:

● improved efficiency of ski school operations resulting in increased utilization of resort assets, including the ski runs and thus increased revenue;

● increased safety for ski school participants;

● improved peace of mind for participants who could locate current positions of friends and family anywhere on the mountain—an aspect deemed to be especially useful to parents in trying to keep track of children, ski schools instructors tracking the whereabouts of their students, or the ski patrol trying to locate missing skiers;

● enhanced skier experiences on the slopes by keeping score of performance statistics and enabling the skier to compare rankings with friends, family, and competitors;

● extension of the skiing experience beyond the slopes by creating an online memory of skiers’ time on the mountain to share at a later date.

As an SSI partner, each resort would have two options for infrastructure deployment. The infrastructure would support the range of applications that SSI would provide to the resort operators and guests. The options were:

(1) a resort purchases infrastructure that included a three-year life span with license and services contract charges yearly for three years,

(2) a resort leases infrastructure for three years with the license and services contract charged annually for three years.

The partnership agreement called for SSI to provide a user-friendly process for customers through three elements:

(1) integrating Flaik into existing point-of-sales systems to simplify the rental process for users,

(2) providing upselling of data to parents of ski school participants,

(3) providing optimal placement locations for interactive kiosks in congregation areas such as lodges for customers to use across the resort.

Revenue-sharing opportunities between SSI and its resort partners included the upselling of performance data to parents of ski school participants, provision of wireless access to customers using the whispar service, and rental of Flaik devices to non-ski school participants during the first phase of deployment.

The infrastructure and supporting technologies utilized by SSI were sourced from leading technology providers around the world and, where necessary, adapted to alpine environmental conditions. SSI’s current ecosystem of network partners included Wireless Tech Group, CMD, Power Converter Technologies, Strix Systems Inc., MassMedia Studios, and Abuzz Technologies.

SSI believed that its primary competitive advantages lay in continual innovation through an evergreen researchand-

development (ERD) program that would allow SSI to update the functionality, flexibility, and interactivity of its front-end user software on a seasonal basis and its hardware every 12 to 18 months. The company planned to protect its intellectual property through a variety of means, including patents, trademarks, copyrights, trade secret designs, and circuit layouts. The company also planned to use and enforce confidential nondisclosure agreements.

SSI identified the company’s business activities as subject to relatively high risk factors, risks that were related to its business activities and also of a general business nature.

SSI executives fully acknowledged that the company’s risks were higher than those generally faced by other companies.

These risks included limited operating history and forecasted losses, intellectual property, national and international regulations, specific country laws, dependence on third-party suppliers, schedule delays, seasonal market fluctuations, and competition. To manage such risks, SSI managers prepared a risk-management plan detailing both preventive and contingency actions.

A Global Market for SSI?

SSI executives recognized that signing the agreement with Mt. Buller was “just baby steps” on a long road and the only way to grow business was to expand into international markets given the seasonality of the ski industry. The company’s executives had identified several countries as its target market, including the United States, Canada, Japan, Europe, China, and New Zealand.

In-house market research suggested that the North American market was the most promising market. One reason was the abundance of information SSI had been able to acquire on the North American market. Although there was more limited information on other target market countries, the executives aimed to spend time investigating those other country markets. They wanted to identify and aggressively address countries throughout the world that had snow skiing activities. As Kenny put it in June 2006:

We currently have one location, i.e., Mt. Buller. And, we need to be in more resorts in Australia, but there are only five major ski resorts and four minor ones here in this country. The most lucrative market, of course, is the USA where there are 493 ski resorts. We could focus on Japan, but that takes a different protocol and we would have to redesign our technology. However, we have had inquiries from Japan and there are a couple of people associated with Hokkaido resorts. We need to think this through.

Case Discussion Questions

1. Assess the company as a potential investor. Use a thorough SWOT analysis as a basis for your assessment. Utilize the VIRO analytical tools from the resource-based view to assess SSI’s core competences.

2. What are the major risks the company faces as it implements

a. its domestic market strategy?

b. “born global” strategy?

3. What advice do you have for SSI founders for future international expansion? Which market(s) should SSI expand into first?

Step by Step Answer: