During 2021, Susan incurred and paid the following expenses for Beth (her daughter), Ed (her father), and

Question:

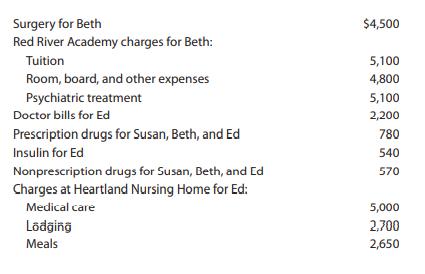

During 2021, Susan incurred and paid the following expenses for Beth (her daughter), Ed (her father), and herself:

Beth qualifies as Susan’s dependent, and Ed would also qualify except that he receives $7,400 of taxable retirement benefits from his former employer. Beth’s psychiatrist recommended Red River Academy because of its small classes and specialized psychiatric treatment program that is needed to treat Beth’s illness. Ed, who is a paraplegic and diabetic, entered Heartland in October. Heartland offers the type of care that he requires.

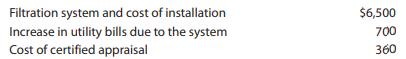

Upon the recommendation of a physician, Susan has an air filtration system installed in her personal residence. She suffers from severe allergies. In connection with this equipment, Susan incurs and pays the following amounts during the year:

The system has an estimated useful life of 10 years. The appraisal was to determine the value of Susan’s residence with and without the system. The appraisal states that the system increased the value of Susan’s residence by $2,200. Ignoring the AGI floor, what is the total of Susan’s expenses that qualifies for the medical expense deduction?

Step by Step Answer:

South-Western Federal Taxation 2022 Individual Income Taxes

ISBN: 9780357519073

45th Edition

Authors: James C. Young, Annette Nellen, William A. Raabe, Mark Persellin, William H. Hoffman