Pat is 40, is single, and has no dependents. She received a salary of $390,000 in 2021.

Question:

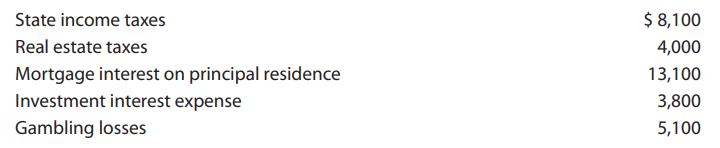

Pat is 40, is single, and has no dependents. She received a salary of $390,000 in 2021. She earned interest income of $11,000, dividend income of $15,000, gambling winnings of $14,000, and interest income from private activity bonds (issued in 2017) of $40,000. The dividends are not qualified dividends. The following additional information is relevant. Compute Pat’s tentative minimum tax for 2021.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South-Western Federal Taxation 2022 Individual Income Taxes

ISBN: 9780357519073

45th Edition

Authors: James C. Young, Annette Nellen, William A. Raabe, Mark Persellin, William H. Hoffman

Question Posted: