On September 18, 2022, Gerald received land and a building from Lei as a gift. Lei paid

Question:

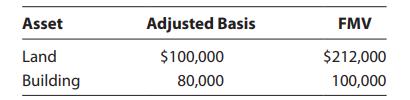

On September 18, 2022, Gerald received land and a building from Lei as a gift. Lei paid no gift tax on the transfer. Lei’s records show the following:

a. Determine Gerald’s adjusted basis for the land and building.

b. Assume instead that the fair market value of the land was $87,000 and that of the building was $65,000. Determine Gerald’s adjusted basis for the land and building.

Transcribed Image Text:

Asset Land Building Adjusted Basis $100,000 80,000 FMV $212,000 100,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (3 reviews)

a Geralds basis in the assets received carries over from Lei So Gerald will have a bas...View the full answer

Answered By

Salmon ouma

I am a graduate of Maseno University, I graduated with a second class honors upper division in Business administration. I have assisted many students with their academic work during my years of tutoring. That has helped me build my experience as an academic writer. I am happy to tell you that many students have benefited from my work as a writer since my work is perfect, precise, and always submitted in due time. I am able to work under very minimal or no supervision at all and be able to beat deadlines.

I have high knowledge of essay writing skills. I am also well conversant with formatting styles such as Harvard, APA, MLA, and Chicago. All that combined with my knowledge in methods of data analysis such as regression analysis, hypothesis analysis, inductive approach, and deductive approach have enabled me to assist several college and university students across the world with their academic work such as essays, thesis writing, term paper, research project, and dissertation. I have managed to help students get their work done in good time due to my dedication to writing.

5.00+

4+ Reviews

16+ Question Solved

Related Book For

South Western Federal Taxation 2023 Essentials Of Taxation Individuals And Business Entities

ISBN: 9780357720103

26th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

On September 18, 2021, Gerald received land and a building from Lei as a gift. No gift tax was paid on the transfer. Leis records show the following. a. Determine Geralds adjusted basis for the land...

-

On September 18, 2016, Gerald received land and a building from Frank as a gift. Frank's adjusted basis and the fair market value at the date of the gift are as follows: No gift tax was paid on the...

-

On September 18, 2013, Gerald received land and a building from Frank as a gift. Frank's adjusted basis and the fair market value at the date of the gift are as follows: Asset Adjusted Basis FMV...

-

Prepare journal entries to record each of the following sales transactions for the sales company. The company uses a perpetual inventory system and the gross method. 1. April 1st Sold for $3,000,...

-

Using 1913 as the base year with a value of 100, the ENR construction cost index (CCI) for August 2009 was 8563.35. For August 2010, the CCI value was 8837.38. (a) What was the inflation rate for...

-

Assuming that in Exercise 14-2 the balance sheet approach is used, prepare a journalized adjusting entry for bad debts expense. Aging of accounts receivable indicates that an $8,000 balance in the...

-

We see that 75 of the 264 people in the study allowed the pressure to reach its maximum level of \(300 \mathrm{mmHg}\), without ever saying that the pain was too much (MaxPressure=yes). Use this...

-

The Byrd Company had the following transactions during 2007 and 2008: 1. On December 24, 2007 a computer was purchased on account from Computers International for $60,000. Terms of the sale were...

-

Vaughn Company uses the perpetual method, a sales journal, a cash receipts journal, and a general journal to record transactions with its customers. The cost of all merchandise sold was 65% of the...

-

Dan bought a hotel for $2,600,000 in January 2018. In May 2022, he died and left the hotel to Ed. While Dan owned the hotel, he deducted $289,000 of cost recovery. The fair market value in May 2022...

-

Roberto has received various gifts over the years. He has decided to dispose of several of these assets. What is the recognized gain or loss from each of the following transactions, assuming that no...

-

Consider the following industries and indicate whether you think each would have a low or high current ratio (e.g., above or below 1.25). Explain your thinking. a. Telecommunications (like Rogers...

-

Requests from users for system enhancements or changes are one of the more challenging aspects of systems support, as described in the textbook. Research this issue on the Web, and discuss it with...

-

Suppose a firm has the following information: Accounts payable 5 $1 million; notes payable = $1.1 million; short-term debt = $1.4 million; accruals 5 $500,000; and long-term bonds = $3 million. What...

-

Determine the headwater depth for a culvert that conveys a flow of 0. 5 m 3 /s under inlet control conditions. The culvert is circular and has a square edge inlet which is mitered with a headwall and...

-

Suppose a firm has the following information: Operating current assets = $2.7 million; operating current liabilities= $1.5 million; long-term bonds = $3 million; net plant and equipment = $7.8...

-

Determine the depth and width of a straight trapezoidal channel (Cs = 1. 0) lined with weeping love grass which is expected to carry Q = 0. 75 m 3 /s. The channel bottom slope is S = 0. 02 and its...

-

Refer to P3.9. The following linear regression results were obtained using these data: Required A. Determine the revenue formula using the linear regression output. B. What is the estimated revenue...

-

An annual report of The Campbell Soup Company reported on its income statement $2.4 million as equity in earnings of affiliates. Journalize the entry that Campbell would have made to record this...

-

Whitney received $75,000 of taxable income in 2019. All of the income was salary from her employer. What is her income tax liability in each of the following alternative situations? a. She files...

-

For 2019, Sherri has a short-term loss of $2,500 and a long-term loss of $4,750. a. How much loss can Sherri deduct in 2019? b. How much loss will Sherri carry over to 2020, and what is the character...

-

In 2019, Tom and Amanda Jackson (married filing jointly) have $200,000 of taxable income before considering the following events: a. On May 12, 2019, they sold a painting (art) for $110,000 that was...

-

31 (Mandatory) (2 points) Total cost of goods sold per unit consists of ________. Question 31 options: volume cost + labor cost materials cost per unit + labor cost per unit labor cost - volume...

-

I need step-by-step instructions on how to input this into QuickBooks Week Ending August 22, 2026 Melanie is ready for another great week. She has a big wreath workshop coming up that she is hoping...

-

Auditing typically refers to financial statement audits or an objective examination and evaluation of a company's financial statements - usually performed by an external third party. Audits can be...

Study smarter with the SolutionInn App