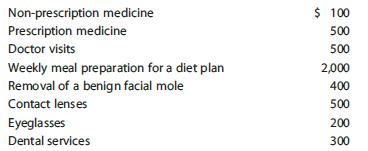

Aaron, age 55, has an adjusted gross income in 2016 of $30,000. His expenses are as follows:

Question:

Aaron, age 55, has an adjusted gross income in 2016 of $30,000. His expenses are as follows:

What is Aaron’s itemized deduction for medical expenses?

a. $0

b. $1,500

c. $2,000

d. $4,500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (3 reviews)

To calculate Aarons itemized deduction for medical expen...View the full answer

Answered By

Charles mwangi

I am a postgraduate in chemistry (Industrial chemistry with management),with writing experience for more than 3 years.I have specialized in content development,questions,term papers and assignments.Majoring in chemistry,information science,management,human resource management,accounting,business law,marketing,psychology,excl expert ,education and engineering.I have tutored in other different platforms where my DNA includes three key aspects i.e,quality papers,timely and free from any academic malpractices.I frequently engage clients in each and every step to ensure quality service delivery.This is to ensure sustainability of the tutoring aspects as well as the credibility of the platform.

4.30+

2+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2017 Comprehensive

ISBN: 9781305874169

40th Edition

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young

Question Posted:

Students also viewed these Business questions

-

Multiple Choice Questions 1. Walters, an individual, received the following in 2016: W-2 income .........................................................................$10,000 Federal tax refund for...

-

1- How might a taxpayer postpone or delay the recognition of income? 2-Are there advantages to leasing rather than buying assets? 3-How can donating appreciated stock to a charitable organization,...

-

1. The current income tax system was: a. Designed solely to raise money to run the government b. Authorized by the founding fathers when the government was formed c. Not designed with social...

-

Asset allocation explains a large portion of a portfolio return. However, the implementation issues involved inthe asset allocation process may reduce the efficiency of the asset allocation strategy,...

-

River Corporation, the investment banking company, often has extra cash to invest. Suppose River buys 600 shares of Eathen, Inc., stock at $40 per share. Assume River expects to hold the Eathen stock...

-

A 2.4-L gasoline fuelled internal combustion engine produces a maximum power of 200 hp when the fuel is burned stoichiometrically with air. The thermal efficiency of the engine at this maximum power...

-

Mass transfer from a bubble. Calculate the mass transfer coefficient for the air-water system for bubbles rising at a gas velocity of \(5 \mathrm{~cm} / \mathrm{s}\) in a pool of stagnant liquid. Use...

-

In most large corporations, ownership and management are separated. What are the main implications of this separation?

-

IVANHOE COMPANY Trial Balance August 31, 2022 Before Adjustment After Adjustment Cr. Dr. Cash $10,246 Cr. Dr. $10.246 Accounts Receivable 8,272 8.836 Supplies 2,350 470 Prepaid Insurance 3,760 2,350...

-

Kellye, a teacher, volunteers for eight hours per week at a school for high-risk children, a qualified charitable organization. Kellyes normal rate for teaching is $30 per hour. Kellyes out-of-pocket...

-

Compare the thickness required for a 2 m diameter flat plate, designed to resist a uniform distributed load of 10 kN/m 2 , if the plate edge is a. Completely rigid; b. Free to rotate. Take the...

-

All horses have manes. Write the negation of the statement.

-

How can the dividend yield expected by the market on a stock index be estimated from futures contracts on a stock index?

-

Consider a palletizer at a bottling plant that has a first cost of \(\$ 150,000\), operating and maintenance costs of \(\$ 17,500\) per year, and an estimated net salvage value of \(\$ 25,000\) at...

-

Reconsider Problem 32. Determine which city should be recommended based on an incremental present worth analysis. Data from problem 32 Quantum Logistics, Inc., a wholesale distributor, is considering...

-

Given the transfer function \[H(z)=\frac{z\left[z-\cos \left(\omega_{0} ight) ight]}{z^{2}-2 \cos \left(\omega_{0} ight) z+1}\] (a) Where are its poles located exactly on the unit circle? (b) Using...

-

Ivan, an industrial engineering student, is working on a homework problem for Engineering Economy. He needs to calculate the PW at 12 percent of a cash flow series with \(\$ 1,000\) at \(t=3, \$...

-

A 90% interest in Saxton Corporation was purchased by Palm Incorporated on January 2, 2011. The capital stock balance of Saxton Corporation was $3,000,000 on this date, and the balance in retained...

-

How is use of the word consistent helpful in fraud reports?

-

Find the monthly mortgage payments on the following mortgage loans using either your calculator or the table in Exhibit: a. $80,000 at 6.5 percent for 30 years b. $105,000 at 5.5 percent for 20 years...

-

Use Worksheet 5.2. Aurelia Montenegro is currently renting an apartment for $725 per month and paying $275 annually for renters insurance. She just found a small town-house that she can buy for...

-

Use Worksheet 5.3. Jennie and Caleb McDonald need to calculate the amount that they can afford to spend on their first home. They have a combined annual income of $47,500 and have $27,000 available...

-

Potts Company uses a job costing system and had the following data available for 20X3. Materials purchased on account Direct Materials requisitioned Indirect Materials requisitioned Direct labor...

-

At the beginning of the summer, Humphrey Nelson was looking for a way to earn money to pay for his college tuition in the fall. He decided to start a lawn service business in his neighborhood. To get...

-

Carmen Camry operates a consulting firm called Help Today, which began operations on December 1. On December 31, the company's records show the following selected accounts and amounts for the month...

Study smarter with the SolutionInn App