Assume the same facts as in Problem 40 with the following modifications. Mitch is killed in

Question:

Assume the same facts as in Problem 40 with the following modifications.

• Mitch is killed in a rock slide while mountain climbing in November 2016, and the insurer pays Alicia’s estate $400,000.

• Bert’s executor did not make a QTIP election.

• Alicia’s IRAs were the Roth type (not traditional).

• The record date for the Drab Corporation dividend is September 5, 2016 (not September 3, 2016).

• On November 7, 2016, Alicia’s estate receives from the IRS an $8,000 income tax refund on the taxes she paid for the preceding calendar year

What amount is included in Alicia’s gross estate?

Data From Problem 40:

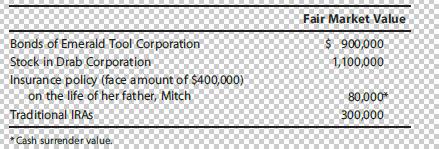

At the time of her death on September 4, 2016, Alicia held the following assets.

Alicia was also the life tenant of a trust (fair market value of $2 million) created by her late husband Bert. (The executor of Bert’s estate had made a QTIP election.) In October, Alicia’s estate received an interest payment of $11,500 ($6,000 accrued before September 4, 2016) paid by Emerald and a cash dividend of $9,000 from Drab. The Drab dividend was declared on August 19 and was payable to date of record shareholders on September 3, 2016. Although Mitch survives Alicia, she is the designated beneficiary of the policy. The IRAs are distributed to Alicia’s children. What amount is included in Alicia’s gross estate?

Step by Step Answer:

South Western Federal Taxation 2017 Comprehensive

ISBN: 9781305874169

40th Edition

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young