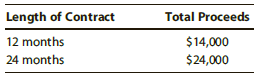

Bigham Corporation, an accrual basis calendar year taxpayer, sells its services under 12-month and 24-month contracts. The

Question:

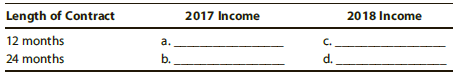

Determine the income to be recognized in taxable income in 2017 and 2018.

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Transcribed Image Text:

Length of Contract 12 months 24 months Total Proceeds $14,000 $24,000 Length of Contract 12 months 24 months 2017 Income 2018 Income a. b. C. d.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 71% (7 reviews)

RevProc 200434 permits an accrual basis taxpayer to defer recognition of income for advance payments ...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2018 Comprehensive

ISBN: 9781337386005

41st Edition

Authors: David M. Maloney, William H. Hoffman, Jr., William A. Raabe, James C. Young

Question Posted:

Students also viewed these Business questions

-

2. [-/20 Points] DETAILS SERPSE10 23.2.P.011. MY NOTES ASK YOUR TEACHER PRACTICE ANOTHER A flat surface of area 2.50 m is rotated in a uniform electric field of magnitude E = 6.00 x 105 N/C. (a)...

-

Which of the following are true or false? a) Purchase of fixed assets is a use of funds. b) For funds flow statement, provision for taxation will be treated as an item of internal source. A B C D...

-

Tapper Corp., an accrual basis calendar year corporation, was organized on January 2, year 1. During year 1, revenue was exclusively from sales proceeds and interest income. The following information...

-

Which sets of lines can be removed without stopping the code from compiling and while printing the same output? (Choose three.) A. Lines 15 and 17 B. Lines 16 and 23 C. Lines 17, 18, and 22 D. Line...

-

Maximize f = 88x1 + 86x2 + 100x3 + 100x4 subject to 3x1 + 2x2 + 2x3 + 5x4 200 2x1 + 2x2 + 4x3 + 5x4 100 x1 + x2 + x3 + x4 200 x1 40 Use the simplex method. Assume all variables are nonnegative.

-

Using the histograms (from Section 6.6, Exercises 9-12), estimate the median, the mode, and the expectation. 1. 2. 3. 4. 0.25 r 0.2 0.15 0.1 0.05 0 2 46 10 Measurement 0.3 0.25 0.2 0.15 E 0. 0.05 0...

-

Consider the FS two-column configuration for the separation of methanol and water in Figure 20.2 and (a) determine the number of degrees of freedom for the overall system, (b) determine the number of...

-

Yvonne and Simon form Ion Corporation. Yvonne transfers equipment (basis of $110,000 and fair market value of $165,000). Simon invests $130,000 of cash. They each receive 100 shares in Ion...

-

When Liam Cote decided to help his cousin Felix Cote turn around his business, he had no idea that things were as bad as they were. Liam knew that the bank's loan was coming due and the company could...

-

Calculate Z, HR, and sR by the Soave/Redlich/Kwong equation for the substance and conditions given by one of the parts of Pb. 6.14, and compare results with values found from suitable generalized...

-

What strategies and steps can organizations pursue to combat the SCM talent shortage?

-

Harper is considering three alternative investments of $10,000. Assume that the taxpayer is in the 25% marginal tax bracket for ordinary income and 15% for qualifying capital gains in all tax years....

-

The information that follows is for Cob Company at and for the year ended December 31, 2016. Cob's operating segments are cost centers currently used for internal planning and control purposes....

-

The accompanying figure depicts a distillation column that is used in a petroleum plant to fractionate (i.e. separate) a liquid feed stream containing equimolar amounts of benzene and toluene. The...

-

Cartman Enterprises will raise $2 million by selling preferred stock. The par value of the preferred stock is $100, and the annual dividend rate is 4%. A single share of Cartman Enterprises preferred...

-

1. "Whole Lotta Love" by Led Zeppelin is based on a riff. What is the song form and how does this dissection help analyze how the song is performed? What role does the vocal play play in contrast to...

-

Describe the field and what information goes in the labeled sections: . 1. Name - 2. Category - 3. Initial quantity on hand - 4. As of Date - 5. Reorder Point - 6. Inventory Asset account 7....

-

A. Calculate the value 5 years hence of a deposit of `1,000 made today if the interest rate is (a) 8 per cent, (b) 10 per cent, (c) 12 per cent, and (d) 15 per cent. B. If you deposit Rs.5,000 today...

-

Use a calculator to find the value of expression rounded to two decimal places. sin -1 (-0.12)

-

Show that gj concave AHUCQ Abadie For nonnegative variables, we have the following corollary.

-

Assume that in addition to the information in Problem 43, Nell had the following items in 2015: Personal casualty gain on an asset held for four months............$10,000 Personal casualty loss on an...

-

Jane Smith, age 40, is single and has no dependents. She is employed as a legal secretary by Legal Services, Inc. She owns and operates Typing Services located near the campus of Florida Atlantic...

-

Mason Phillips, age 45, and his wife, Ruth, live at 230 Wood Lane, Salt Lake City, UT 84101. Mason's Social Security number is 111-11-1111. Ruth's Social Security number is 123-45-6789. Mason and...

-

8.6 In Figure P8.6 the experimental unit step response of a process system is shown. (a) What is the transfer function that can be used to best describe the system dynamics among the following. 1 (1)...

-

An 84 year old female arrives to the ER today with her son with a complaint of new onset of confusion. What are your differential diagnoses for a patient with new altered mental status? Go through...

-

Complete the Price, Advertising, and Profitability chart. a . ?Notice that the series for $ 2 5 , 0 0 0 , 0 0 0 ?is already on the chart. b . ?Add the series for advertising budgets $ 5 0 , 0 0 0 , 0...

Study smarter with the SolutionInn App