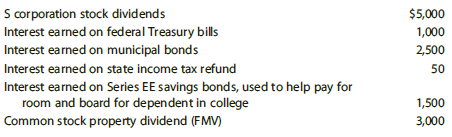

Cole, a 48-year-old married individual, received the following in 2017: In addition, Cole spent $500 on lottery

Question:

In addition, Cole spent $500 on lottery scratch-off cards in 2017. All of the cards were losers except for one, from which Cole won $1,000. Given these facts, what total amount from the above should be included in gross income on Cole€™s 2017 tax return?

a. $ 4,550

b. $ 6,550

c. $11,050

d. $11,550

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South-Western Federal Taxation 2018 Comprehensive

ISBN: 9781337386005

41st Edition

Authors: David M. Maloney, William H. Hoffman, Jr., William A. Raabe, James C. Young

Question Posted: