Data, Inc., purchased and placed in service a $5,000 computer on August 24, year 3- This is

Question:

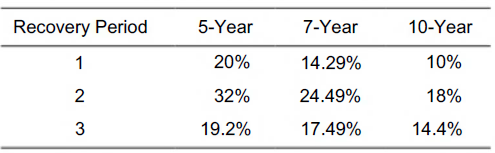

Data, Inc., purchased and placed in service a $5,000 computer on August 24, year 3- This is the only asset purchase during the year. Section 179 expensing was not elected. Using the excerpt of the MACRS half-year convention table below, what is the MACRS depreciation in year 3 for the computer?

a. $500

b. $715

c. $960

d. $1,000

Transcribed Image Text:

5-Year 7-Year 10-Year Recovery Period 1 20% 14.29% 10% 18% 32% 24.49% 19.2% 17.49% 14.4%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

Answered By

Emel Khan

I have the ability to effectively communicate and demonstrate concepts to students. Through my practical application of the subject required, I am able to provide real-world examples and clarify complex ideas. This helps students to better understand and retain the information, leading to improved performance and confidence in their abilities. Additionally, my hands-on approach allows for interactive lessons and personalized instruction, catering to the individual needs and learning styles of each student.

5.00+

2+ Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2019 Comprehensive

ISBN: 9781337703017

42th Edition

Authors: David M. Maloney, William A. Raabe, William H. Hoffman, James C. Young

Question Posted:

Students also viewed these Business questions

-

On February 4, 2014, Jackie purchased and placed in service a car she purchased for $21,500. The car was used exclusively for her business. Compute Jackies cost recovery deduction in 2014 assuming no...

-

On October 15, 2016, Jon purchased and placed in service a used car. The purchase price was $25,000. This was the only business-use asset Jon acquired in 2016. He used the car 80% of the time for...

-

On February 4, 2015, Jackie purchased and placed in service a car she purchased for $21,500. The car was used exclusively for her business. Compute Jackie's cost recovery deduction in 2015 assuming...

-

The following two equations have a common solution of (1, 2, 3). Which equation would complete a system of three linear equations in three variables having solution set {(1, 2, 3)}? x+y+z=6 2x = y +...

-

Let S be a set containing n distinct objects. Verify that ex/(I - x)k is the exponential generating function for the number of ways to choose m of the objects in S, for 0 < m < ft, and distribute...

-

The current liabilities section of the December 31, 2023, balance sheet of Livestream Company included notes payable of $14,000 and interest payable of $490. The note payable was issued to Tanner...

-

If your instructor assigns a marketing plan for your class, we hope you will be excitedfor two reasons. First, you will get insights into trying to actually do marketing that often go beyond what you...

-

Stevens Textiles's 2010 financial statements are shown below: Balance Sheet as of December 31, 2010 (Thousands of Dollars) a. Suppose 2011 sales are projected to increase by 15% over 2010 sales. Use...

-

Can you explain why we neglect the gravitational force between most objects unless at least one of them has an enormous mass (Earth, moon, Sun)

-

Richard Penn lives in Harrisburg, Pennsylvania. Richard is the president of an architectural firm. Richard has become known throughout the community for excellent work and honesty in his business...

-

Stem Corp, bought a machine in February of year 7 for $20,000. Then Stem bought furniture in November of year 7 for $30,000. Both machines were placed in service for business purposes immediately...

-

Data, Inc., purchased and placed in service a $5,000 computer on August 24, year 3- Tills is the only asset purchase during die year. Section 179 expensing was not elected. The computer was sold...

-

Together, EMI, Sony BMG Music Entertainment, Universal Music Group Recordings, Inc., and Warner Music Group Corp. produced, licensed, and distributed 80 percent of the digital music sold in the...

-

2. www.rwcruises.com is the official website for RW Cruise Packages. a. Besides offering service to book cruise package online, propose THREE (3) other functions of www.rwcruises.com (6 marks) b....

-

Select all that apply In variance analysis, measuring accomplishments centers on two key computations. Identify the two computations.

-

a Quality engineer wanted to construct and s - chart control process variability. The average standard deviation of the collected sample was 0 . 2 . Samples with 1 5 components for each determine the...

-

P9.3.1 Determine what the following pseudo-Java method outputs on input n. Prove your answer by induction on the call tree: integer foo (natural n) { if (n

-

A taxpayer owns an interest in a partnership which rents property. This is his sole source of income and produces defined taxable income. Together, he receives $70,000 of rental income. One of the...

-

Identify an example of spontaneous creativity from the following Settling a disagreement quickly in a simple way Organizing annual meetings and get-togethers innovatively Establishing win-win...

-

An 8.0 kg crate is pulled 5.0 m up a 30 incline by a rope angled 18 above the incline. The tension in the rope is 120 N, and the crates coefficient of kinetic friction on the incline is 0.25. a. How...

-

A list of the items that Peggy sold and the losses she incurred during the current tax year is as follows: Yellow, Inc. stock ................................................... $ 1,600 Peggy's...

-

A list of the items that Peggy sold and the losses she incurred during the current tax year is as follows: Yellow, Inc. stock ................................................... $ 1,600 Peggy's...

-

Falcon, Inc., paid salaries of $500,000 to its employees during its first year of operations. At the end of the year, Falcon had unpaid salaries of $45,000. a. Calculate the salary deduction if...

-

Wanda is reviewing her tax returns from the previous year and is shocked at how much tax she paid the government. She had good income but had to pay a large number of self-employment taxes on top of...

-

Katies Cleaning Service has cleaning contracts for 15 apartments, 45 family homes, and 25 office buildings. She estimates that an apartment takes 4 hours to clean, a home takes 6 hours to clean, and...

-

1. Quikpak sells returnable containers to major food processors. The price received for the containers is 2 per unit. Of this amount 1.25 is profit contribution. Quikpak is considering an attempt to...

Study smarter with the SolutionInn App