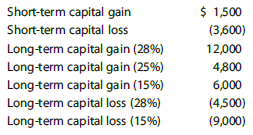

Elliott has the following capital gain and loss transactions for 2017. After the capital gain and loss

Question:

After the capital gain and loss netting process, what is the amount and character of Elliott€™s gain or loss?

Transcribed Image Text:

$ 1,500 Short-term capital gain Short-term capital loss (3,600) Long-term capital gain (28%) Long-term capital gain (25%) Long-term capital gain (15%) Long-term capital loss (28%) Long-term capital loss (15%) 12,000 4,800 6,000 (4,500) (9,000)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 69% (13 reviews)

Elliott first nets the shortterm gains and losses against each other and the longterm gains and loss...View the full answer

Answered By

ZIPPORAH KISIO LUNGI

I have worked on several other sites for more than five years, and I always handle clients work with due diligence and professionalism. Am versed with adequate experience in the fields mentioned above in which have delivered quality papers in research, thesis, essays, blog articles, and so forth.

I have gained extensive experience in assisting students to acquire top grades in biological, business and IT papers. Notwithstanding that, I have 7+ years of experience in corporate world software design and development.

5.00+

194+ Reviews

341+ Question Solved

Related Book For

South-Western Federal Taxation 2018 Comprehensive

ISBN: 9781337386005

41st Edition

Authors: David M. Maloney, William H. Hoffman, Jr., William A. Raabe, James C. Young

Question Posted:

Students also viewed these Business questions

-

Coline has the following capital gain and loss transactions for 2016. Short-term capital gain .................................. $ 5,000 Short-term capital loss ......................................

-

Coline has the following capital gain and loss transactions for 2015. Short-term capital gain ......................................... $ 5,000 Short-term capital loss...

-

Coline has the following capital gain and loss transactions for 2017. Short-term capital gain ......................................... $ 5,000 Short-term capital loss...

-

On January 26, Nova Co. borrowed cash from Conrad Bank by issuing a 30-day note with a face amount of $60,000. Assume a 360-day year. a. Determine the proceeds of the note, assuming the note carries...

-

Use the graph to answer the following questions. a. According to the graph, is there a surplus or a shortage of baht in exchange for U.S. dollars? Briefly explain. b. To maintain the pegged exchange...

-

Oxmoor Corporation prepared the following adjusted trial balance. Oxmoor Corporation Adjusted Trial Balance December 31, 2019 Required: Prepare a single-step income statement for Oxmoor for the year...

-

What is labor economics? Which types of questions do labor economists analyze?

-

Stratco Corporation computed a pretax financial income of $40,000 for the first year of its operations ended December 31, 2008. Included in financial income was $50,000 of nontaxable revenue, $20,000...

-

Mike Scott was a high school graduate who worked as a receptionist in the corporate offices of a large corporation. Scott had no particular plans for his career development; However, he wanted to...

-

King's Landing is a large amusement theme park located in Virginia. The park hires high school and college students to work during the summer months of May, June, July, August, and September. The...

-

Coline has the following capital gain and loss transactions for 2017. After the capital gain and loss netting process, what is the amount and character of Colines gain or loss? Short-term capital...

-

Enzo is a single taxpayer with the following gains and losses for 2017: $2,100 short-term capital loss. $24,000 long-term capital gain from sale of stock. $14,000 1231 gain that is all unrecaptured ...

-

Consider the reaction: What volume of 0.150 M Li2S solution is required to completely react with 125 mL of 0.150 M Co(NO 3 ) 2 ? LiS(aq) + CO(NO3)2(aq) 2 LINO3(aq) + CoS(s)

-

Large countries are often interested in forming a regional free trade bloc to capture the efficiencies it can create. Do you think these agreements generally improve living standards in smaller...

-

Some people believe that the rise of regional trading blocs threatens free trade progress made by the World Trade Organization (WTO). What arguments can you present to counter this point of view? Do...

-

Explain how you would obtain a simple random sample from this population: varsity athletes at your school.

-

What is it called when trade shifts away from nations not belonging to a trading bloc and toward member nations?

-

In his 1868 work, Carl Wunderlich concluded that temperatures above 100.4 Fahrenheit should be considered feverish. In a 1992 study, Maryland researchers suggested that 99.9 Fahrenheit was a more...

-

Write an SQL statement to create a view named ProjectHoursToDateView that shows the values of PROJECT.ProjectID, PROJECT.Name as ProjectName, PROJECT.MaxHours as ProjectMaxHour and the sum of...

-

Decades after the event, Johnson & Johnson (J&J), the 130-year-old American multinational, is still praised for swiftly The company indicated that its response was based on the expectations set forth...

-

Samantha is the president and sole shareholder of Toucan Corporation. She is paid an annual salary of $500,000, while her son, Aaron, the company's chief financial officer, is paid a salary of...

-

Whether compensation paid to a corporate employee is reasonable is a question of fact to be determined from the surrounding circumstances. How would the resolution of this problem be affected by each...

-

Whether compensation paid to a corporate employee is reasonable is a question of fact to be determined from the surrounding circumstances. How would the resolution of this problem be affected by each...

-

A bank can either invest money for three months at 4.00% or for nine months at 4.50%. Ignoring actual/360 day count adjustments for the purpose of this question, the three against nine FRA quote the...

-

Shuggy Otis, an executive at Slapfish Corp. (SC) intends to retire in 11 years. SC just announced that it will start depositing $500.00 at the end of each quarter into each of its workers' retirement...

-

On January 1, the Hanover Beverage Company replaced the palletizing machine on one of its juice lines. The cost of the machine was $195,000. The machine's expected life is five years or 480,000...

Study smarter with the SolutionInn App