In 2022, Gail changed from the lower of cost or market FIFO method to the LIFO inventory

Question:

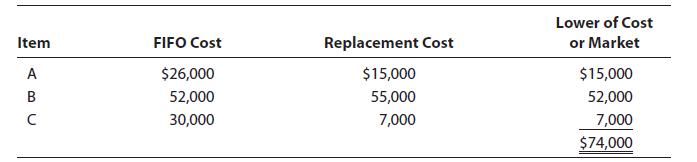

In 2022, Gail changed from the lower of cost or market FIFO method to the LIFO inventory method. The ending inventory for 2021 was:

Item C was damaged goods, and the replacement cost used was actually the estimated selling price of the goods. The actual cost to replace item C was $32,000.

a. What is the correct beginning inventory for 2022 under the LIFO method?

b. What immediate tax consequences (if any) will result from the switch to LIFO?

Transcribed Image Text:

Item ABU FIFO Cost $26,000 52,000 30,000 Replacement Cost $15,000 55,000 7,000 Lower of Cost or Market $15,000 52,000 7,000 $74,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (4 reviews)

a Gail must restore the beginning inventory value to actual cost to use LIFO ...View the full answer

Answered By

Shameen Tahir

The following are details of my Areas of Effectiveness. The following are details of my Areas of Effectiveness English Language Proficiency, Organization Behavior , consumer Behavior and Marketing, Communication, Applied Statistics, Research Methods , Cognitive & Affective Processes, Cognitive & Affective Processes, Data Analysis in Research, Human Resources Management ,Research Project,

Social Psychology, Personality Psychology, Introduction to Applied Areas of Psychology,

Behavioral Neurosdence , Historical and Contemporary Issues in Psychology, Measurement in Psychology, experimental Psychology,

Business Ethics Business Ethics An introduction to business studies Organization & Management Legal Environment of Business Information Systems in Organizations Operations Management Global Business Policies Industrial Organization Business Strategy Information Management and Technology Company Structure and Organizational Management Accounting & Auditing Financial Accounting Managerial Accounting Accounting for strategy implementation Financial accounting Introduction to bookkeeping and accounting Marketing Marketing Management Professional Development Strategies Business Communications Business planning Commerce & Technology Human resource management General Management Conflict management Leadership Organizational Leadership Supply Chain Management Law Corporate Strategy Creative Writing Analytical Reading & Writing Other Expertise Risk Management Entrepreneurship Management science Organizational behavior Project management Financial Analysis, Research & Companies Valuation And any kind of Excel Queries.

4.70+

16+ Reviews

34+ Question Solved

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

In 2016, Gail changed from the lower of cost or market FIFO method to the LIFO inventory method. The ending inventory for 2015 was computed as follows: Item C was damaged goods, and the replacement...

-

In 2017, Gail changed from the lower of cost or market FIFO method to the LIFO inventory method. The ending inventory for 2016 was computed as follows: Item C was damaged goods, and the replacement...

-

In 2021, Gail changed from the lower of cost or market FIFO method to the LIFO inventory method. The ending inventory for 2020 was: Item C was damaged goods, and the replacement cost used was...

-

In Exercises determine whether the statement is true or false. If it is false, explain why or give an example that shows it is false. The curve represented by the parametric equations x = t and y =...

-

What is the basic purpose of transaction logging? Microsoft Access does not have automatic transaction logging. Is this a deficiency, or is it not really an important consideration in database...

-

Some people believe human resource management is an area reserved for those who cant do anything else. Why do you think this belief has emerged? Is there any factual basis for it?

-

In several accounting situations it seems like there is more than one acceptable way to account for a transaction. Is this a significant issue? Are there situations where it can lead to ethical...

-

Llano Lamps has the following revenue and cost functions: Revenue = $ 70 per unit Cost = $ 90,000 + $ 40 per unit a. What is the break-even point in units? b. What is the break-even point in dollars?

-

Q1 - At the heart of understanding marketing is something known as the marketing concept. In essence the marketing concept states: focus on creating transactions understand customer wants and needs...

-

Ven Company is a retailer. In 2022, its before-tax net income for financial reporting purposes was $600,000. This included a $150,000 gain from the sale of land held for several years as a possible...

-

The Wren Construction Company reports its Federal taxable income by the completed contract method. At the end of 2022, the company completed a contract to construct a building at a total cost of...

-

On January 1, 2010, Gillette Co. acquired an 80% interest in Schick Corp. for $500,000. There is no active trading market for Schick's stock. The fair value of Schick's net assets was $600,000 and...

-

What obstacles do you think may stand in the way of an attempt by organisations to adopt a new style of management in which the new style manager is supportive, a team leader, a coach and facilitator?

-

Which dispute resolution technique would you advise for the residents and developers in the dispute over new hotels planned for natural areas in Hawaii?

-

What potential problem with conventional arbitration is resolved by final offer arbitration?

-

It is common practice for companies to make two allowances for doubtful accounts: 1. The specific allowance is based on accounts the company has reason to suspect may not be paid. 2. The general...

-

For each of the above In Practice Cases answer the following question and justify your answer with reference to case evidence: Which of the six strands of strategic integration are evident in the...

-

Wonder Dog Leash Company is seeking to raise cash and is in negotiation with Big Bucks finance company to pledge their receivables. BB is willing to loan funds against 75% of current (that is, not...

-

Find the cross product a x b and verify that it is orthogonal to both a and b. a = (t, 1, 1/t), b = (t 2 , t 2 , 1)

-

Sunset, Inc., a 501(c)(3) exempt organization that is classified as a private foundation, generates investment income of $500,000 for the current tax year. This amount represents 18% of Sunsets...

-

Sunset, Inc., a 501(c)(3) exempt organization that is classified as a private foundation, generates investment income of $500,000 for the current tax year. This amount represents 18% of Sunsets...

-

For each of the following organizations, determine its UBTI and any related UBIT. a. AIDS, Inc., an exempt charitable organization that provides support for individuals with AIDS, operates a retail...

-

Jerald earned net income of $1,200,000 in 2024. There are 950,000 shares of common stock outstanding the entire year. The preferred shareholders received a $80,000 cash dividend. Compute Jerald's...

-

On January 1, 2015, Y. Knott Inc. issued $100,000 in bonds payable with an interest coupon of 10%. Since the market rate of interest was close to 12%, Y. Knott had to issue the bonds at 94 (that is,...

-

Based on the following information for the year ended December 31, 2018, what is Earnings Per Share (in dollars and cents)? Retained Earnings $ 340,000 January 1, 2018 Cost of Goods Sold $ 620,000...

Study smarter with the SolutionInn App