Myers, who is single, has compensation income of $69,000 in 2017. He is an active participant in

Question:

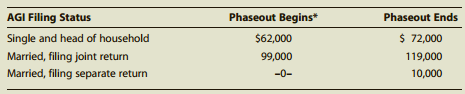

See Exhibit 19.3, Phaseout of IRA Deduction of an Active Participant in 2017.

Transcribed Image Text:

Phaseout Begins* AGI Filing Status Single and head of household Married, filing joint return Married, filing separate return Phaseout Ends $ 72,000 119,000 10,000 $62,000 99,000 -0-

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 54% (11 reviews)

For 2017 the contribution ceiling is the smaller of 5500 or 11000 for spousal IRAs or 00 of compensa...View the full answer

Answered By

Charles mwangi

I am a postgraduate in chemistry (Industrial chemistry with management),with writing experience for more than 3 years.I have specialized in content development,questions,term papers and assignments.Majoring in chemistry,information science,management,human resource management,accounting,business law,marketing,psychology,excl expert ,education and engineering.I have tutored in other different platforms where my DNA includes three key aspects i.e,quality papers,timely and free from any academic malpractices.I frequently engage clients in each and every step to ensure quality service delivery.This is to ensure sustainability of the tutoring aspects as well as the credibility of the platform.

4.30+

2+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation Individual Income Taxes 2018

ISBN: 9781337385893

41st Edition

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young, Nellen

Question Posted:

Students also viewed these Business questions

-

Myers, who is single, has compensation income of $68,000 in 2016. He is an active participant in his employer's qualified retirement plan. Myers contributes $5,500 to a traditional IRA. Of the $5,500...

-

Myers, who is single, reports compensation income of $68,000 in 2016. He is an active participant in his employer's qualified retirement plan. Myers contributes $5,500 to a traditional IRA. Of the...

-

Myers, who is single, reports compensation income of $69,000 in 2017. He is an active participant in his employer's qualified retirement plan. Myers contributes $5,500 to a traditional IRA. Of the...

-

What is wrong with the following code fragment? int[] a; for (int i = 0; i < 10; i++) a[i] = i * i;

-

Fontenot SA was organized in 2018 and began operations at the beginning of 2019. The company is involved in interior design consulting services. The following costs were incurred prior to the start...

-

Does Nokia have a truly global strategy or just a series of regional strategies?

-

How does an objects interface relate to services that the object provides?

-

The balance sheet of Lamont Bros. follows: a. What portions of Lamonts assets were provided by debt, contributed capital, and earned capital? Reduce contributed capital by the cost of the treasury...

-

Subject is Customer Experience Design and this question is asked by prof at centennial college for corporate account management course. Read Online: United Crew Tells Mom That Her Crying Baby is...

-

Read the case XYZ Company: An Integrated Capital Budgeting Instructional Case and answer the following question: Should the replacement asset be purchased? That is, does it make economic (financial)...

-

Joanna, age 44, defers $23,000 in a qualified 401(k) plan in 2017. a. What amount must be returned to Joanna and by what date? b. In what year will the amount be taxed? c. What percent of the tax...

-

In 2017, Caos compensation before his employers contribution to a SEP is $66,000. Up to what amount can Caos employer contribute and deduct in 2017?

-

What is inventory?

-

Inflation Rate in the News. Find a news report that states both monthly and annual inflation rates. Using the methods in this unit, check whether the rates agree. Explain.

-

The production of a gold mine decreases by 5% per year. What is the approximate half-life for the production decline> Based on this approximate half-life and assuming that the mine's current annual...

-

What proportion of customers rate the company with top box survey responses (which is defined as scale levels 4 and 5) on quality, ease of use, price, and service in the Customer Survey worksheet?...

-

Wildcat Pizza is looking toward the future and is considering revising its target capital structure. Currently, they utilize a 50-50% mix of debt and equity, but are considering a target capital...

-

You want to buy forward British sterling to be delivered eight months from today. The spot rate today is $1:49=. The rate of return in the United States is 3 percent per year; in Britain, 5 percent...

-

1. What could be the reason why Mller is using distributors (export mode) in markets outside Germany? 2. What would be the main reasons why Mller is using a joint venture solution (intermediate mode)...

-

Teasdale Inc. manufactures and sells commercial and residential security equipment. The comparative unclassified balance sheets for December 31, 2015 and 2014 are provided below. Selected missing...

-

During 2016, Learphart Corporation contributes $35,000 to its qualified pension plan. Normal cost for this year is $15,000, and the amount necessary to pay retirement benefits on behalf of employee...

-

Joanna, age 44, defers $23,000 in a qualified 401(k) plan in 2016. a. What amount must be returned to Joanna and by what date? b. In what year will the amount be taxed? c. What percent of the tax...

-

Zack, a sole proprietor, has earned income of $85,000 in 2016 (after the deduction for one-half of self-employment tax). What is the maximum contribution Zack may make to a defined contribution Keogh...

-

1. Define latent heat and how it is different than specific heat capacity. 2. Describe how a phase diagram changes when changing from a solid to a liquid. 3. Describe how work done is related to a...

-

In a large vaccination clinic, patients arrive at the rate of 50 per hour. The clinic is staffed with five nurses and it takes on average 6 minutes for a nurse to vaccinate a patient. Both patient...

-

Calculate the missing value. Beginning cash balance add : cash receipts Collection of notes receivable Proceeds from sale of securities collection from credit sales Total receipts Total available...

Study smarter with the SolutionInn App