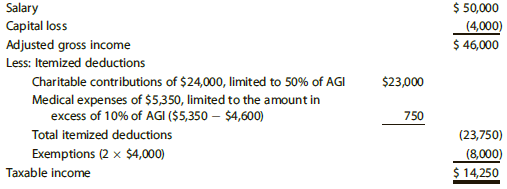

Robert and Susan Reid had an NOL of $30,000 in 2017. They had $14,250 oftaxable income for

Question:

Write a letter to Robert and Susan informing them of the amount of the remaining NOLto be carried forward if the loss is applied against the 2015 taxable income. Also prepare a memo for the tax files. Their address is 201 Jerdone Avenue, Conway, SC 29526.

Transcribed Image Text:

Salary Capital loss Adjusted gross income Less: Itemized deductions Charitable contributions of $24,000, limited to 50% of AGI Medical expenses of $5,350, limited to the amount in excess of 10% of AGI ($5,350 – $4,600) Total itemized deductions Exemptions (2 x $4,000) Taxable income $ 50,000 (4,000) $ 46,000 $23,000 750 (23,750) (8,000) $ 14,250

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 63% (11 reviews)

Hoffman Young Raabe Maloney Nellen CPAs 5191 Natorp Boulevard Mason OH 45040 February 6 2018 Mr and ...View the full answer

Answered By

Gilbert Chesire

I am a diligent writer who understands the writing conventions used in the industry and with the expertise to produce high quality papers at all times. I love to write plagiarism free work with which the grammar flows perfectly. I write both academics and articles with a lot of enthusiasm. I am always determined to put the interests of my customers before mine so as to build a cohesive environment where we can benefit from each other. I value all my clients and I pay them back by delivering the quality of work they yearn to get.

4.80+

14+ Reviews

49+ Question Solved

Related Book For

South Western Federal Taxation Individual Income Taxes 2018

ISBN: 9781337385893

41st Edition

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young, Nellen

Question Posted:

Students also viewed these Business questions

-

Robert and Susan Reid had an NOL of $30,000 in 2016. They had no taxable income for 2014 and $14,250 of taxable income for 2015 computed as Write a letter to Robert and Susan informing them of the...

-

Robert and Susan (both 39) are married and have 2 children. Their son, Dylan, is 8 and their daughter, Harper, is 3. Susan sells pharmaceuticals for the Bendigo Drug Company. Robert is a teacher at...

-

Red Corporation manufactures hand tools in the United States. For the current year, the QPAI derived from the manufacture of hand tools was $1 million. Red's taxable income for the current year was...

-

Our thoughts return to Ambrose and his nuts and berries. Ambroses utility function is U(x1, x2) = 4x1 + x2, where x1 is his consumption of nuts and x2 is his consumption of berries. (a) Let us find...

-

Consider the sociological study of Exercise 43. Out of a group of non-isolated doctors, let yn be the percent who adopted the new drug after n months. Then yn satisfies the difference equation yn =...

-

Citrus Products Inc. is a medium-sized producer of citrus juice drinks with groves in Indian River County, Florida. Until now, the company has confined its operations and sales to the United States;...

-

Assume that the standard deviations of the tin-coating weights determined by any one of the 4 laboratories have the common value \(\sigma=0.012\), and that it is desired to be \(95 \%\) confident of...

-

Write the answers to the following questions Consider the following income statement: Sales ......... $734,800 Costs ........ $327,600 Depreciation ..... $102,000 EBIT ............ ? Tax (35%)...

-

Based on the data shown below, calculate the regression line (each value to two decimal places) y = x y 3 15.12 4 16.8 5 14.48 6 16.46 7 15.84 8 14.72 9 16.5 X +

-

Deb Sikes started her practice as a design consultant on November 1, 2017. During the first month of operations, the business completed the following transactions: Nov. 1 Received $39,000 cash and...

-

Assume that in addition to the information in Problem 49, Rick and Sara had $3,700 of taxable income for 2015 computed as follows: a. Determine Rick and Saras recomputed taxable income for 2015. b....

-

Pete and Polly are married and file a joint return. They had the following income and deductions for 2017: Salary ............................................................................. $50,000...

-

Round, flat, seeded, plain, crowned with cheese, or cut into croutons, bagels form the basis of every menu item at Finagle A Bagel. So many other shops will just grab onto whatever is hot, whatever...

-

Milton Industries expects free cash flows of $4 million each year. Milton's corporate tax rate is 21%, and its unlevered cost of capital is 13%. Milton also has outstanding debt of $17.08 million,...

-

A two reactor system is comprised of a CSTR and a PFR in series. The PFR is twice the volume of the CSTR. Sketch the effluent concentration from the two reactor system (i.e., effluent from the second...

-

What were the circumstances surrounding the determination by the National Highway Traffic Safety Administration that the Pinto fuel system was defective?

-

calculate dividend received and franking credit.H - TOTAL DIVIDENDS Fully franked dividends received from listed companies 21000 Unfranked dividend from listed companies 2000 23000 Amity prepared the...

-

A stream of nitrogen is initially at 20 bar and 400 K, and at a velocity 10 m/s. Determine the final velocity and temperature of the stream if its pressure is reduced to 5 bar by passing through: a)...

-

When the condensation rate is greater than the evaporation rate, what happens to the air?

-

Why can wastewater treatment requirements in Hawaii be less stringent than those in most locations on the U.S. mainland?

-

Harold conducts a business with the following results for the year: Revenue ......................................................... $20,000 Depreciation on car...

-

Samantha, an executive, has AGI of $100,000 before considering income or loss from her miniature horse business. Her outside income comes from prizes for winning horse shows, stud fees, and sales of...

-

Sarah owns a vacation cabin in the Tennessee mountains. Without considering the cabin, she has gross income of $65,000. During the year, she rents the cabin for two weeks for $2,500 and uses it...

-

On Monday, April 5, 2010, just before 3:00 in the afternoon, miners at Massey Energy Corporation's Upper Big Branch coal mine in southern West Virginia were in the process of a routine shift change....

-

Ethics in Human Resource Practices HR teams will play vital roles in organizations to ensure ethical behavior and compliance. To be effective, they must first place an emphasis on ethical behavior...

-

Why do managers struggle with ethics when it comes to making strategic management decisions for their organization?

Study smarter with the SolutionInn App