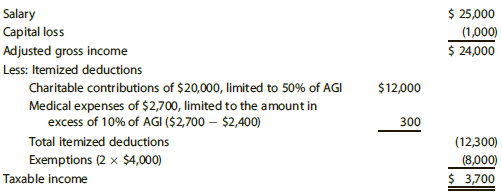

Assume that in addition to the information in Problem 49, Rick and Sara had $3,700 of taxable

Question:

a. Determine Rick and Sara€™s recomputed taxable income for 2015.

b. Determine the amount of Rick and Sara€™s 2017 NOL to be carried forward from 2015 to 2016.

Transcribed Image Text:

Salary Capital loss Adjusted gross income Less: Itemized deductions Charitable contributions of $20,000, limited to 50% of AGI Medical expenses of $2,700, limited to the amount in excess of 10% of AGI ($2,700 – $2,400) Total itemized deductions Exemptions (2 x $4,000) Taxable income $ 25,000 (1,000) $ 24,000 $12,000 300 (12,300) (8,000) $ 3,700

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

a b Salary Capital loss 2017 net operating loss Adjusted gross income Less ...View the full answer

Answered By

Niala Orodi

I am a competent and an experienced writer with impeccable research and analytical skills. I am capable of producing quality content promptly. My core specialty includes health and medical sciences, but I can competently handle a vast majority of disciplines.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation Individual Income Taxes 2018

ISBN: 9781337385893

41st Edition

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young, Nellen

Question Posted:

Students also viewed these Business questions

-

Assume that in addition to the information in Problem 43, Nell had the following items in 2014: Personal casualty gain on an asset held for four months ................ $10,000 Personal casualty loss...

-

Assume that in addition to the information in Problem 43, Nell had the following items in 2013: Personal casualty gain on an asset held for four months ..................... $10,000 Personal casualty...

-

Assume that in addition to the information in Problem 42, Nell had the following items in 2016: Personal casualty gain on an asset held for four months ...................$10,000 Personal casualty...

-

Problem 3.3 Minimize the functional J(x()) = f sx (s) x (s) ds, = 1 sr (s) i (s) ds, 0 subject to the endpoint conditions x (0) = 0 and x (1) = 1.

-

After caffeine is absorbed into the body, 13% is eliminated from the body each hour. Assume that a person drinks an 8-oz cup of brewed coffee containing 130 mg of caffeine, and the caffeine is...

-

a. Rework Problem 18-4 using the spreadsheet model. b. Construct data tables for the intrinsic value and Black-Scholes exercise value for this option and graph the relationship. Include possible...

-

Show that if \(\mu_{i}=\mu+\alpha_{i}\) and \(\mu\) is the mean of the \(\mu_{i}\), it follows that \[\sum_{i=1}^{k} n_{i} \alpha_{i}=0\]

-

Three individuals are considering forming a partnership to operate a metal fabricating shop. It is anticipated that significant contributions of capital will be necessary during the first 18 months...

-

3. Find the derivative for the following functions: (a) f(x) = 5.23x- 7.14x - 14.69x + 24.36 (b) f(x)=+3 (c) f(x)=5x+4x-3x+19 x-2

-

Lightbulbs labeled 40 W, 60 W, and 100 W are connected to a 120 V/60 Hz power line as shown in FIGURE P32.62. What is the rate at which energy is dissipated in each bulb? 40 W 120 V/60 Hz O100 W 60 W...

-

During 2017, Rick and his wife, Sara, had the following items of income and expense to report: Gross receipts from business ................................................. $400,000 Business...

-

Robert and Susan Reid had an NOL of $30,000 in 2017. They had $14,250 oftaxable income for 2015 computed as follows: Write a letter to Robert and Susan informing them of the amount of the remaining...

-

Show that a language is decidable iff some enumerator enumerates the language in the standard string order.

-

A big tank initially contains 1000 L of a salt-water solution, which has a concentration of 0.02 kg of salt per liter. Brine (a solution of salt in water) containing 0.03 kg of salt per liter of...

-

We are all watching the Super Bowl this Sunday. Let's say Eagle Birdie said to Chief Kanssy "I bet you 1000.00 that the Philadelphia Eagles will win BY TEN POINTS in the Super bowl" Chief Kanssy...

-

Explain the following terms: Consent Implied and expressed consent Consent to medical treatment Self Defence Provocation Necessity Duress Legal Authority Part 11 what is meant by a true defence? what...

-

In the context of preventing fraud in organizations, it is difficult to defraud an organization if Blank______. Multiple choice question. its internal control systems have proper checks and balances...

-

The sales budget for XYZ company in the coming year is based on a 15 percent quarterly growth rate with the first-quarter sales projection at $200 million. In addition to this basic trend, the...

-

In which atmospheric layer does all our weather occur?

-

Determine two different Hamilton circuits in each of the following graphs. A B F G

-

Trevor, a friend of yours from high school, works as a server at the ST Café. He asks you to help him prepare his Federal income tax return. When you inquire about why his bank deposits...

-

Classify each of the following expenditures as a deduction for AGI, a deduction from AGI, or not deductible: a. Sam gives cash to his father as a birthday gift. b. Sandra gives cash to her church. c....

-

Amber, a publicly held corporation, currently pays its president an annual salary of $900,000. In addition, it contributes $20,000 annually to a defined contribution pension plan for him. As a means...

-

A nursing team is having a routine meeting. One of the nurses, Stephen, is at the end of a 12-hour shift, and another nurse, Tanya, is just beginning hers. Tanya is a senior nurse in the unit with...

-

Assume that you are the leadership team of a convenience store chain that has more than 300 outlets. The company is facing an inventory shrinkage problem, and store managers report that the main...

-

1 . An employee at Amy's candles has noticed that some order quantities in the two reports presented are different although the order numbers are the same. We normally refer to such data as dirty....

Study smarter with the SolutionInn App