Sparrow Corporation (a calendar year, accrual basis taxpayer) had the following transactions in 2022, its second year

Question:

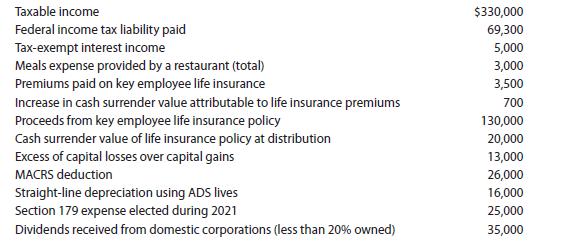

Sparrow Corporation (a calendar year, accrual basis taxpayer) had the following transactions in 2022, its second year of operation:

Sparrow uses the LIFO inventory method, and its LIFO recapture amount increased by $10,000 during 2022. In addition, Sparrow sold property on installment during 2021. The property was sold for $40,000 and had an adjusted basis at sale of $32,000. During 2022, Sparrow received a $15,000 payment on the installment sale. Finally, assume that no additional first-year depreciation was claimed. Compute Sparrow's current E & P.

Transcribed Image Text:

Taxable income Federal income tax liability paid Tax-exempt interest income Meals expense provided by a restaurant (total) Premiums paid on key employee life insurance Increase in cash surrender value attributable to life insurance premiums Proceeds from key employee life insurance policy Cash surrender value of life insurance policy at distribution Excess of capital losses over capital gains MACRS deduction Straight-line depreciation using ADS lives Section 179 expense elected during 2021 Dividends received from domestic corporations (less than 20% owned) $330,000 69,300 5,000 3,000 3,500 700 130,000 20,000 13,000 26,000 16,000 25,000 35,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (5 reviews)

Sparrow Corporations current E P is computed as follows For 2021 and 2022 busine...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

Sparrow Corporation (a calendar year, accrual basis taxpayer) had the following transactions in 2016, its second year of operation. Taxable income...

-

Sparrow Corporation (a calendar year, accrual basis taxpayer) had the following transactions in 2014, its second year of operation. Sparrow uses the LIFO inventory method, and its LIFO recapture...

-

Question: Sparrow Corporation (a calendar year, accrual basis taxpayer) had the follows transactions in 2015, its second year of operation. Taxable income $330,000 Federal income tax liability paid...

-

Ari Goldstein issued $300,000 of 11%, five-year bonds payable on January 1, 2024. The market interest rate at the date of issuance was 10%, and the bonds pay interest semiannually. Requirements 1....

-

Define the terms alpha version, beta version, and production version. Are there well defined criteria for deciding when an alpha version becomes a beta version or a beta version becomes a production...

-

A spreadsheet containing R&E Suppliess 2015 pro forma financial forecast as shown in Table 3.5 is available for download from McGraw-Hills Connect or your course instructor (see the Preface for more...

-

What is the future equivalent of \($1,000\) invested at 8% simple interest for 3 years?

-

1. To compute the price elasticity of demand, we divide the percentage change in_______ by the percentage change in _______and then take the _______value of the ratio. 2. If a 10 percent increase in...

-

In this week's reading in The Goal, we learn that the accounting definition of inventory appears to penalize what would otherwise be good operations management. Is this a common occurrence in your...

-

Corporate executives engage in reorganizations to improve shareholder value. If shareholder value increases, the reorganization often is deemed a success. If shareholder value falls, corporate...

-

How does the receipt of boot affect the taxation of shareholders in a transaction that qualifies under 368?

-

The pressure developed by a centrifugal pump for Newtonian liquids that are not highly viscous depends upon the liquid density, the impeller diameter, the rotational speed, and the volumetric flow...

-

In 2018, Thomas transferred land he bought in 2009 worth \(\$ 100,000\) to Andy Co. in return for 50 shares of stock. The land has an adjusted basis of \(\$ 30,000\) and is subject to a \(\$ 50,000\)...

-

Distinguish between international and domestic economic issues.

-

In 2018, Bob will sell land that he bought in 2008 for \(\$ 50,000\) to Tom. The selling price is \(\$ 250,000\). Tom has given Bob two options for the sale. Under option 1, Bob would receive the...

-

During 2018, Jane Mason incurred the following home expenses: Assume that Jane qualified for the home office deduction, all of the above expenditures qualified for the deduction as home office...

-

Tara Corporation had current E\&P of \(\$ 320,000\) in 2018 . During 2018, it distributed numerous items to its sole shareholder, Anne. Indicate the effects of the distribution to Anne and Tara...

-

For the following projects, compute NPV, IRR, MIRR, profitability index, and payback. If these projects are mutually exclusive, which one(s) should be done? If they are independent, which one(s)...

-

Write an SQL statement to display all data on products having a QuantityOnHand greater than 0.

-

In Problem 44, how much of the Whitman loss belongs to Ann and Becky? Beckys stock basis is $41,300. In problem At the beginning of the year, Ann and Becky own equally all of the stock of Whitman,...

-

In Problem 44, how much of the Whitman loss belongs to Ann and Becky? Beckys stock basis is $41,300. In problem At the beginning of the year, Ann and Becky own equally all of the stock of Whitman,...

-

Whindy Corporation, an S corporation, reports a recognized built-in gain of $80,000 and a recognized built-in loss of $10,000 this year. Whindy holds an $8,000 unexpired NOL carryforward from a C...

-

Draw both chair conformations of the compound shown below. Explain how you drew your Which chair conformation is more stable? original chair conformation. (d) Video: Explain how you drew the second...

-

Find the average and rms value for the following waveform: Current 5A 0.5 1 1.5 2 time -5A

-

Determine the initial and final values of the current where 0.42 I(s) = s(s2+0.35s+0.816)

Study smarter with the SolutionInn App