Suzy contributed assets valued at $360,000 (basis of $200,000) in exchange for her 40% interest in Suz-Anna

Question:

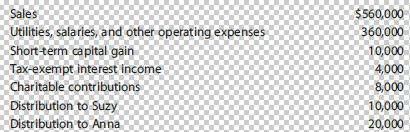

Suzy contributed assets valued at $360,000 (basis of $200,000) in exchange for her 40% interest in Suz-Anna GP (a general partnership). Anna contributed land and a building valued at $640,000 (basis of $380,000) in exchange for the remaining 60% interest. Anna’s property was encumbered by a qualified nonrecourse debt of $100,000, which was assumed by the partnership. The partnership reports the following income and expenses for the current tax year:

During the current tax year, Suz-Anna refinanced the land and building (i.e., the original $100,000 debt was repaid and replaced with new debt). At the end of the year, Suz-Anna had recourse debt of $100,000 for partnership accounts payable and qualified nonrecourse debt of $200,000.

a. What is Suzy’s basis after formation of the partnership? Anna’s basis?

b. What income and separately stated items does the partnership report on Suzy’s Schedule K–1? What items does Suzy report on her tax return?

c. Assume that all partnership debts are shared proportionately. At the end of the tax year, what are Suzy’s basis and amount at risk in her partnership interest?

Step by Step Answer:

South Western Federal Taxation 2017 Comprehensive

ISBN: 9781305874169

40th Edition

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young