5 Assume the same facts as in Problem 31, except that both states employ a three-factor formula,...

Question:

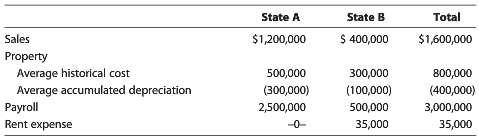

5 Assume the same facts as in Problem 31, except that both states employ a three-factor formula, under which sales are double-weighted. The property factor in A is computed using historical cost; this factor in B is computed using the net depreciated basis. Neither A nor B includes rent payments in the property factor.

Data From Problem 31

Dillman Corporation has nexus in States A and B. Dillman's activities for the year are summarized below.

Determine the apportionment factors for A and B assuming that A uses a three-factor apportionment formula under which sales, property (net depreciated basis), and payroll are equally weighted and B employs a single-factor formula that consists solely of sales. State A has adopted the UDITPA with respect to the inclusion of rent payments in the property factor.

Step by Step Answer:

South Western Federal Taxation 2018 Corporations Partnerships Estates And Trusts

ISBN: 1389

41st Edition

Authors: William H. Hoffman, William A. Raabe, James C. Young, Annette Nellen, David M. Maloney