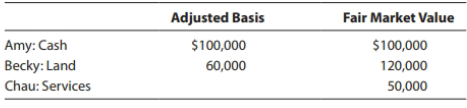

Amy, Becky, and Chau form a business entity with each contributing the following. Their ownership percentages will

Question:

Amy, Becky, and Chau form a business entity with each contributing the following.

Their ownership percentages will be as follows.

Amy ................................... 40%

Becky ................................ 40%

Chau ................................. 20%

Becky's land has a $20,000 mortgage that is assumed by the entity. Chau is an attorney who receives her ownership interest in exchange for legal services. Determine the recognized gain to the owners, the basis for their ownership interests, and the entity's basis for its assets if the entity is organized as:

a. A partnership.

b. A C corporation.

c. An S corporation.

Step by Step Answer:

South-Western Federal Taxation 2019 Essentials Of Taxation Individuals And Business Entities

ISBN: 9781337702966

22nd Edition

Authors: William A. Raabe, James C. Young, Annette Nellen, David M. Maloney