Sarah exchanges a building and land (used in its business) for Tyler's land and building and some

Question:

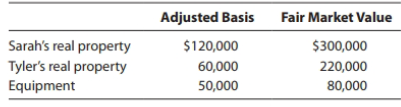

Sarah exchanges a building and land (used in its business) for Tyler's land and building and some equipment (used in its business). The assets have the following characteristics:

a. What are Sarah's recognized gain or loss and basis for the land and building and equipment acquired from Tyler?

b. What are Tyler's recognized gain or loss and basis for the land and building acquired from Sarah?

Transcribed Image Text:

Adjusted Basis Fair Market Value Sarah's real property Tyler's real property Equipment $120,000 $300,000 220,000 60,000 80,000 50,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 86% (15 reviews)

a Amount realized 220000 80000 300000 Adjusted basis 120000 Realized gain 180000 Recognized gain 800...View the full answer

Answered By

Mwangi Clement

I am a tried and tested custom essay writer with over five years of excellent essay writing. In my years as a custom essay writer, I have completed more than 2,000 custom essays in a diverse set of subjects. When you order essays from me, you are working with one of the best paper writers on the web. One of the most common questions I get from customers is: “can you write my essay?” Upon hearing that request, my goal is to provide the best essays and overall essay help available on the web. I have worked on papers in subjects such as Nursing and Healthcare, English Literature, Sociology, Philosophy, Psychology, Education, Religious Studies, Business, Biological Sciences, Communications and Media, Physical Sciences, Marketing and many others. In these fields, my specialties lie in crafting professional standard custom writings. These include, but are not limited to: research papers, coursework, assignments, term papers, capstone papers, reviews, summaries, critiques, proofreading and editing, and any other college essays.

My extensive custom writings experience has equipped me with a set of skills, research abilities and a broad knowledge base that allows me to navigate diverse paper requirements while keeping my promise of quality. Furthermore, I have also garnered excellent mastery of paper formatting, grammar, and other relevant elements. When a customer asks me to write their essay, I will do my best to provide the best essay writing service possible. I have satisfactorily offered my essay writing services for High School, Diploma, Bachelors, Masters and Ph.D. clients.

I believe quality, affordability, flexibility, and punctuality are the principal reasons as to why I have risen among the best writers on this platform. I deliver 100% original papers that pass all plagiarism check tests (Turnitin, Copyscape, etc.). My rates for all papers are relatively affordable to ensure my clients get quality essay writing services at reasonable prices.

4.50+

5+ Reviews

14+ Question Solved

Related Book For

South-Western Federal Taxation 2019 Essentials Of Taxation Individuals And Business Entities

ISBN: 9781337702966

22nd Edition

Authors: William A. Raabe, James C. Young, Annette Nellen, David M. Maloney

Question Posted:

Students also viewed these Business questions

-

Starling Corporation exchanges a yellow bus (used in its business) for Robin Corporation's gray bus and some garage equipment (used in its business). The assets have the following characteristics: a....

-

Cardinal Properties, Inc., exchanges real estate used in its business along with stock for real estate to be held for investment. The stock transferred has an adjusted basis of $45,000 and a fair...

-

Identify each of White Corporation's following assets as an ordinary, capital, or 1231 asset. a. Two years ago, White used its excess cash to purchase a piece of land as an investment. b. Two years...

-

Gombas Company decided to analyze certain costs for October of the current year. There was no beginning inventory. Units started into production equaled 14000, units transferred out equal 12000, and...

-

Define comparative statics analysis. How does it compare with sensitivity analysis or what-if analysis used in finance, act minting, and statistics?

-

What is an unconscionable transaction?

-

Repeat Example 7.3 using \(10 \mathrm{~kg} / \mathrm{h}\) of solvent in each stage. Data From Example 7.3:- The feed of Example 7.2 is extracted three times with pure chloroform at 298 K, using 8...

-

Clark Products makes pizza ovens for commercial use. Michael Clark, CEO, is contemplating producing smaller ovens for use in high school and college kitchens. The activities necessary to build an...

-

The 2020 season was expected to be a year of partying at Cedar Fair. Its namesake theme parkCedar Pointreached its 150 th year, and its Knotts Berry Farm was prepared to celebrate its 100 th...

-

Citron Mechanical Systems makes all sales on credit, with terms 1/15, n/30. During 2019, the list price (pre-discount) of services provided was $687,500. Customers paid $482,000 (list price) of these...

-

Tanya Fletcher owns undeveloped land (adjusted basis of $80,000 and fair market value of $92,000) on the East Coast. On January 4, 2018, she exchanges Communications it with Lisa Martin (an unrelated...

-

Steve owns real estate (adjusted basis of $12,000 and fair market value of $15,000), which he uses in his business. Steve sells the real estate for $15,000 to Aubry (a dealer) and then purchases a...

-

Mergers are often justified by synergies, making the new, combined business more valuable than the individual parts. What are synergies? Briefly describe a potential revenue-enhancing synergy and two...

-

Please read the paper by Ernesto Dal Bo & Guo Xu: "How did a $9 Billion Health Tech Startup End up DOA?" 1. The outcome of the Theranos saga is quite exceptional. How exceptional do you think the...

-

Describe the people dimension of information systems and give an example. Is this dimension as vital as the technology dimension when considering a technology- based solution to a business problem?

-

Type of adjustment Classify the following items as (1) accrued revenue, (2) accrued expense, (3) unearned revenue, or (4) prepaid expense: Line Item Description Classification a. Cash paid for future...

-

Write the email to Rachel (you can make up an email address) that will achieve the negative-news goals of clarity, acceptance, and positive image. Remember that this case deliberately contains...

-

Table 1. Projected cash flows for TopMaverick Ltd (in m) 2016 2017 2018 2019 2020 EBIT(1-t) 80.50 86.14 92.16 98.62 Incremental Working 45.00 48.15 46.71 44.37 Capital Net Capital Expenditure 13.50...

-

Tarika Ltd. is a profitable small business. It has not, however, given much consideration to internal control. For example, in an attempt to keep clerical and office expenses to a minimum, the...

-

Fill in each blank so that the resulting statement is true. 83 + 103 = ______ .

-

Leland pays premiums of $5,000 for an insurance policy in the face amount of $25,000 upon the life of Caleb and subsequently transfers the policy to Tyler for $7,500. Over the years, Tyler pays...

-

Employers often use the Internet as a means of attracting applications from potential employees. Locate an Internet site offering employment opportunities, ideally one provided by a well-known...

-

Employers often use the Internet as a means of attracting applications from potential employees. Locate an Internet site offering employment opportunities, ideally one provided by a well-known...

-

Suppose that a firm manufactures espresso machines. The firm's fixed cost is $1650587, and the variable cost is $89 per machine. If each machine sells for $438, how many espresso machines need to be...

-

What are the advantages of cultural diversity within an organization and how can it gain a competitive advantage from the cultural differences?

-

(a) The graph of y-f(x) is shown. Draw the graph of y(x+4). (b) The graph of y-g(x) is shown Draw the graph of yg (2x)-3. + ?

Study smarter with the SolutionInn App