Siena Industries (a sole proprietorship) sold three 1231 assets on October 10, 2018. Data on these

Question:

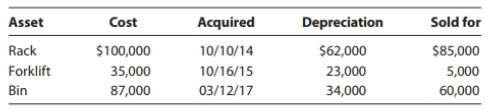

Siena Industries (a sole proprietorship) sold three § 1231 assets on October 10, 2018. Data on these property dispositions are as follows.

a. Determine the amount and the character of the recognized gain or loss from the disposition of each asset.

b. Assuming that Siena has no nonrecaptured net § 1231 losses from prior years, analyze these transactions and determine the amount (if any) that will be treated as a long-term capital gain.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South-Western Federal Taxation 2019 Essentials Of Taxation Individuals And Business Entities

ISBN: 9781337702966

22nd Edition

Authors: William A. Raabe, James C. Young, Annette Nellen, David M. Maloney

Question Posted: