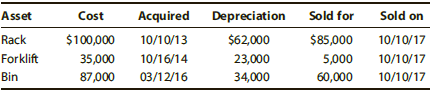

Siena Industries (a sole proprietorship) sold three § 1231 assets during 2017. Data on these property dispositions

Question:

a. Determine the amount and the character of the recognized gain or loss from the disposition of each asset.

b. Assuming that Siena has no nonrecaptured net § 1231 losses from prior years, how much of the 2017 recognized gains is treated as capital gains?

Transcribed Image Text:

Cost Acquired 10/10/13 10/16/14 03/12/16 Depreciation Sold for Sold on Asset Rack 10/10/17 10/10/17 10/10/17 $100,000 35,000 87,000 $62,000 23,000 $85,000 5,000 Forklift Bin 60,000 34,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (6 reviews)

a Siena has 54000 47000 7000 of ordinary income due to 1245 recapture and 7000 of 1231 lo...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2018 Comprehensive

ISBN: 9781337386005

41st Edition

Authors: David M. Maloney, William H. Hoffman, Jr., William A. Raabe, James C. Young

Question Posted:

Students also viewed these Business questions

-

Davidson Industries, a sole proprietorship, sold the following assets in 2014: a. The following questions relate to the sale of the warehouse: (1). What is the adjusted basis of the warehouse? (2)....

-

Davidson Industries, a sole proprietorship, sold the following assets in 2016: a. The following questions relate to the sale of the warehouse: (1). What is the adjusted basis of the warehouse? (2)....

-

Siena Industries (a sole proprietorship) sold three 1231 assets on October 10, 2014. Data on these property dispositions are as follows. a. Determine the amount and the character of the recognized...

-

In a popular carnival ride called The Centrifuge, shown above, riders stand against the inside wall of a large cylinder, which starts spinning. The radius of the circle traveled by the riders is 4 ....

-

Go to the Web site of the Federal Reserve Bank of St. Louis (FRED) (research.stlouisfed.org/fred2/) and download the most recent value and the value from the same month one year earlier from FRED for...

-

Berkwild Company is authorized to issue 2,000,000 shares of common stock. At the beginning of 2019, Berkwild had 248,000 issued and outstanding shares. On July 2, 2019, Berkwild repurchased 4,610...

-

Which of the following statements about the training of a neural network is false? a. The training of a neural network is an iterative process of predicting an observation or batch of observations...

-

Use Worksheet 11.1 Linda Scales is a young career woman whos now employed as the managing editor of a well-known business journal. Although she thoroughly enjoys her job and the people she works...

-

A rectangular block of a material with a modulus of rigidity G=90 ksi is bonded to two rigid horizontal plates. The lower plate is fixed, while the upper plate is subjected to a horizontal force P....

-

In your physics lab you release a small glider from rest at various points on a long, frictionless air track that is inclined at an angle θ above the horizontal. With an electronic...

-

Keshara has the following net § 1231 results for each of the years shown. What would be the nature of the net gains in 2016 and 2017? Tax Year Net 5 1231 Loss Net 5 1231 Gain $18,000 2012 2013...

-

Copper Industries (a sole proprietorship) sold three § 1231 assets during 2017. Data on these property dispositions are as follows: a. Determine the amount and the character of the recognized...

-

Go to the website of the Federal Reserve Bank of St. Louis at http://www.stlouisfed.org. Go to Research and Data and access the Federal Reserve Economic Database (FRED). Compare the present size of...

-

Which of the following statements is (are) correct about agency funds? I. Agency funds should report investment earnings only when they are both measurable and available. II. Agency funds are...

-

What benefits might a company obtain by being a first mover in an industry?

-

How would you define free trade?

-

What are the components of the Porter diamond?

-

What is the national competitive advantage theory?

-

Describe four uses for triggers.

-

If (x) 0 on the interval [a, b], the definite integral gives the exact area under the curve between x = a and x = b.

-

Donna and Steven own all the stock in Pink Corporation (E & P of $2 million). Each owns 1,000 shares and has a basis of $75,000 in the shares. Donna and Steven are married and have two minor...

-

Under what circumstances are losses disallowed to a corporation in liquidation?

-

Under what circumstances are losses disallowed to a corporation in liquidation?

-

Do you envision the business as starting by targeting specific needs of a single target community (e.g. the target is San Francisco), targeting specific needs of a similar set of communities (e.g....

-

Define social media. ( 20 points ) How has social media changed the way marketers and consumers communicate with one another? Explain the implications for marketers. Describe how marketing managers...

-

Find an article or video offering advice on choosing the best financing option for a business. Answer the following questions: Which types of financing did they discuss? What advice did they offer?...

Study smarter with the SolutionInn App