Turtle, a C corporation, reports taxable income of $200,000 before paying salaries to the two equal shareholder-employees,

Question:

Turtle, a C corporation, reports taxable income of $200,000 before paying salaries to the two equal shareholder-employees, Britney and Alan. Turtle follows a policy of distributing all after-tax earnings to the shareholders.

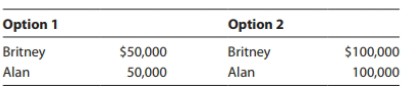

a. Determine the tax consequences for Turtle, Britney, and Alan if the corporation pays salaries as follows. Britney and Alan have no other sources of income.

b. Which option would you recommend' Explain.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South-Western Federal Taxation 2019 Essentials Of Taxation Individuals And Business Entities

ISBN: 9781337702966

22nd Edition

Authors: William A. Raabe, James C. Young, Annette Nellen, David M. Maloney

Question Posted: