WinterWearhouse operates a clothing store specializing in ski apparel. Given the seasonal nature of their business, there

Question:

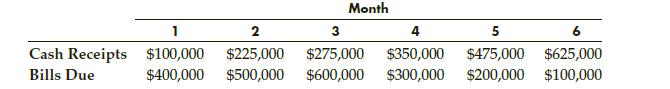

WinterWearhouse operates a clothing store specializing in ski apparel. Given the seasonal nature of their business, there is often somewhat of an imbalance between when bills must be paid for inventory purchased and when the goods are actually sold and cash is received. Over the next 6 months, the company expects cash receipts and requirements for bill paying as follows:

The company likes to maintain a cash balance of at least $20,000 and currently has $100,000 cash on hand. The company can borrow money from a local bank for the following term/rate structure: 1-month at 1%, 2-months at 1.75%, 3-months at 2.49%, 4-months at 3.22%, and 5-months at 3.94%. When needed, money is borrowed at the end of a month and repaid, with interest, at the end of the month in which the obligation is due. For instance, if the company borrows $10,000 for 2 months in month 3, they would have to pay back $10,175 at the end of month 5.

a. Create a spreadsheet model for this problem and solve it.

b. What is the optimal solution?

c. Suppose its bank wants to limit WinterWearhouse to borrowing no more than $100,000 at each level in the term/rate structure. How would this restriction change the solution to the problem?

d. In light of your answer to part c, what would the bank’s borrowing limit need to increase to in order to obtain a feasible solution?

Step by Step Answer:

Spreadsheet Modeling And Decision Analysis A Practical Introduction To Business Analytics

ISBN: 1233

8th Edition

Authors: Cliff T. Ragsdale