Question: Using the monthly data for the period August 2000 to October 2005 (n = 64) in Appendix 5.A, for yit=log returns of a particular firm

Using the monthly data for the period August 2000 to October 2005 (n = 64) in Appendix 5.A, for yit=log returns of a particular firm i = 1, 2, . . . , 6, x1t=monthly log-returns of the 3-month treasury bill rate, x2t=market log-returns (SP500):

(a) Estimate the simple Normal model for each data series separately and test the four model assumptions using auxiliary regressions. Pay particular attention to outliers that might distort M-S testing.

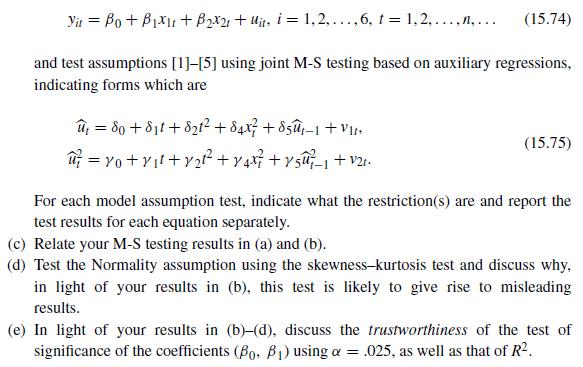

(b) For each of the assets estimate the linear regression model (Table 15.6)

Yit Bo+B+ B2x21 + uit, i = 1, 2,..., 6, 1= 1,2,...,n,... (15.74) and test assumptions [1]-[5] using joint M-S testing based on auxiliary regressions, indicating forms which are = 80+811+821 + 84x +85-1+ VII. (15.75) For each model assumption test, indicate what the restriction(s) are and report the test results for each equation separately. (c) Relate your M-S testing results in (a) and (b). (d) Test the Normality assumption using the skewness-kurtosis test and discuss why, in light of your results in (b), this test is likely to give rise to misleading results. (e) In light of your results in (b)-(d), discuss the trustworthiness of the test of significance of the coefficients (Bo. B) using = .025, as well as that of R.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts