Now suppose the investor in question 26 assigns probabilities of .3 to low growth, .4 to normal

Question:

Now suppose the investor in question 26 assigns probabilities of .3 to low growth, .4 to normal growth, and .3 to high growth. Use the expected monetary value criterion to determine which investment should be chosen.

Question 26

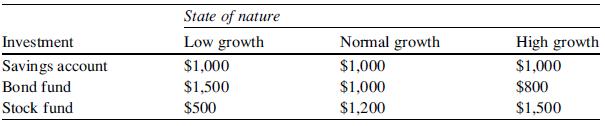

An investor wants to choose among three investment alternatives: a passbook savings account, a government bond fund, and a growth stock fund. The payoffs for a $20,000 investment are given in the following table.

(a) Which investment does applying the minimax regret criterion instruct us to choose?

(b) Which investment does applying the maximin criterion instruct us to choose?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Statistics For Business And Financial Economics

ISBN: 9781461458975

3rd Edition

Authors: Cheng Few Lee , John C Lee , Alice C Lee

Question Posted: