The Journal of Economic Psychology (Vol. 66, 2018) investigated whether high cigarette state tax rates reduces the

Question:

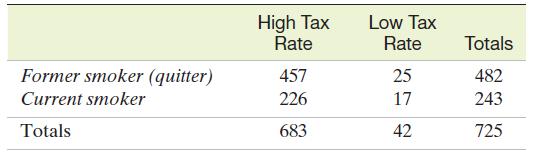

The Journal of Economic Psychology (Vol. 66, 2018) investigated whether high cigarette state tax rates reduces the probability of quitting smoking. Data were collected for 725 current or former smokers. At the time of the data collection, the state tax rate for the current/former smoker was determined and classified as high or low. Based on the study results, consider the following table summarizing the classifications (number of current and former smokers). One of the 725 former or current smokers is randomly selected.

a. Find the probability that the subject quit smoking.

b. Given the subject is from a state with a high tax rate, find probability that the subject quit smoking.

c. Given the subject is from a state with a low tax rate, find probability that the subject quit smoking.

Step by Step Answer:

Statistics For Business And Economics

ISBN: 9780136855354

14th Edition

Authors: James T. McClave, P. George Benson, Terry T Sincich